Buying a Home May Help Shield You from Inflation

Buying a Home May Help Shield You from Inflation

With inflation remaining higher than expected, the cost of goods, services, and everyday expenses continues to rise. This might have you wondering whether now is the right time to buy a home.

Here’s the good news: Homeownership is actually one of the best ways to shield yourself from the rising costs that come with inflation.

A Fixed Mortgage Protects You from Rising Housing Costs

One of the biggest advantages of buying a home with a fixed-rate mortgage is that your largest monthly expense—your mortgage payment—remains stable. While property taxes and insurance may fluctuate slightly, your principal and interest payments won’t change, no matter what happens with inflation.

Rent, on the other hand, tends to increase over time—often at a rate faster than inflation. Data from the Bureau of Economic Analysis (BEA) and the Census Bureau illustrates this trend (see graph below). Renting means facing ongoing price hikes, while homeownership provides long-term financial stability.

While renters may see their expenses increase annually, homeowners with a fixed mortgage rate can secure their monthly payments, simplifying budget planning regardless of inflation fluctuations.

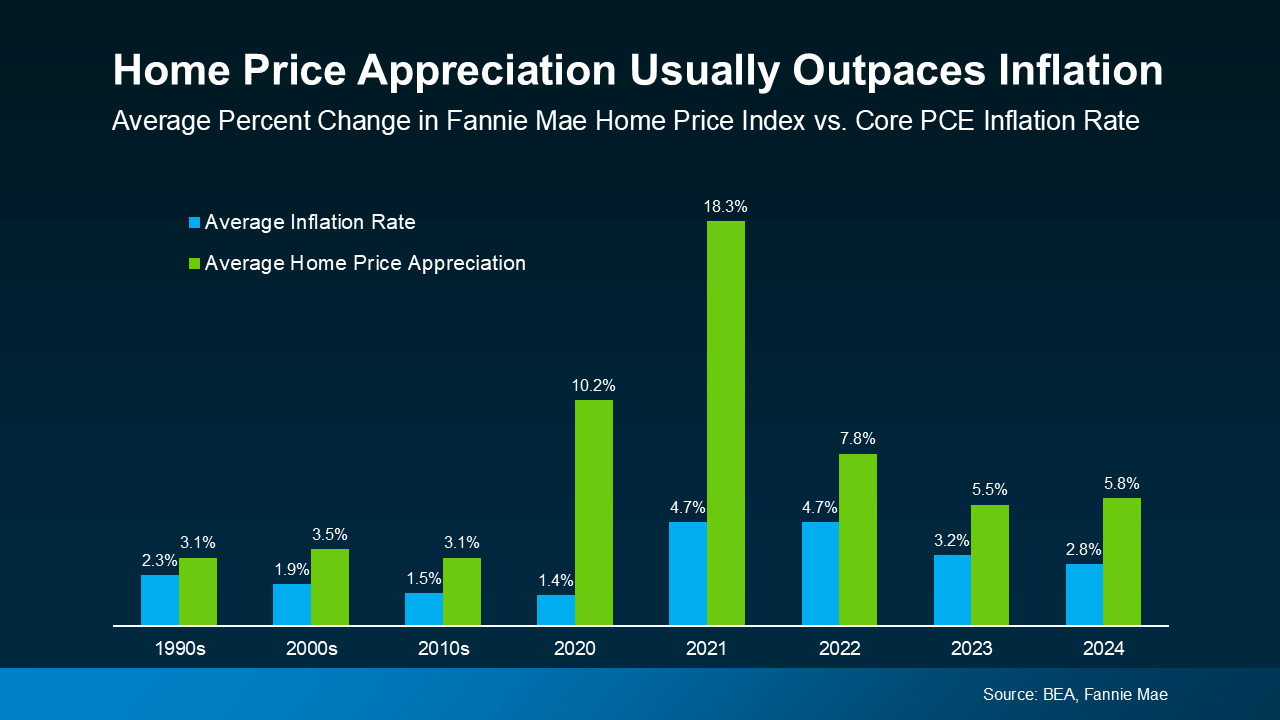

Home Prices Typically Rise Faster Than Inflation

Another compelling reason why homeownership is an effective hedge against inflation is that property values generally appreciate over time, often outpacing inflation. This trend is supported by data from the Bureau of Economic Analysis (BEA) and Fannie Mae, which show that over the long term, home prices tend to increase at a rate faster than the rise in consumer prices (see graph below):

Real estate stands out as one of the most robust long-term investments, particularly during periods of rising prices. While inflation can diminish the value of cash savings, real estate not only retains its value but often appreciates, enabling wealth accumulation.

Conversely, renting provides no safeguard against inflation. In fact, it typically exacerbates financial strain, as landlords may pass on increased costs to tenants through higher rents. As a result, renters find themselves paying more over time without any financial return, while homeowners benefit from rising property values and increased equity.

With continued growth in home prices projected by experts, investing in real estate is likely to appreciate and outpace inflation in the long run.

Bottom Line:

Inflation can lead to fluctuating daily expenses, but homeownership offers financial stability. A fixed-rate mortgage ensures your monthly housing payment remains consistent, unlike rent, which can vary. Moreover, the value of your home is likely to grow after purchase, enhancing your financial security.

How could a stable housing payment affect your budgeting and financial planning for the future?

Categories

Recent Posts