What You Can Do When Mortgage Rates Are a Moving Target

What You Can Do When Mortgage Rates Are a Moving Target

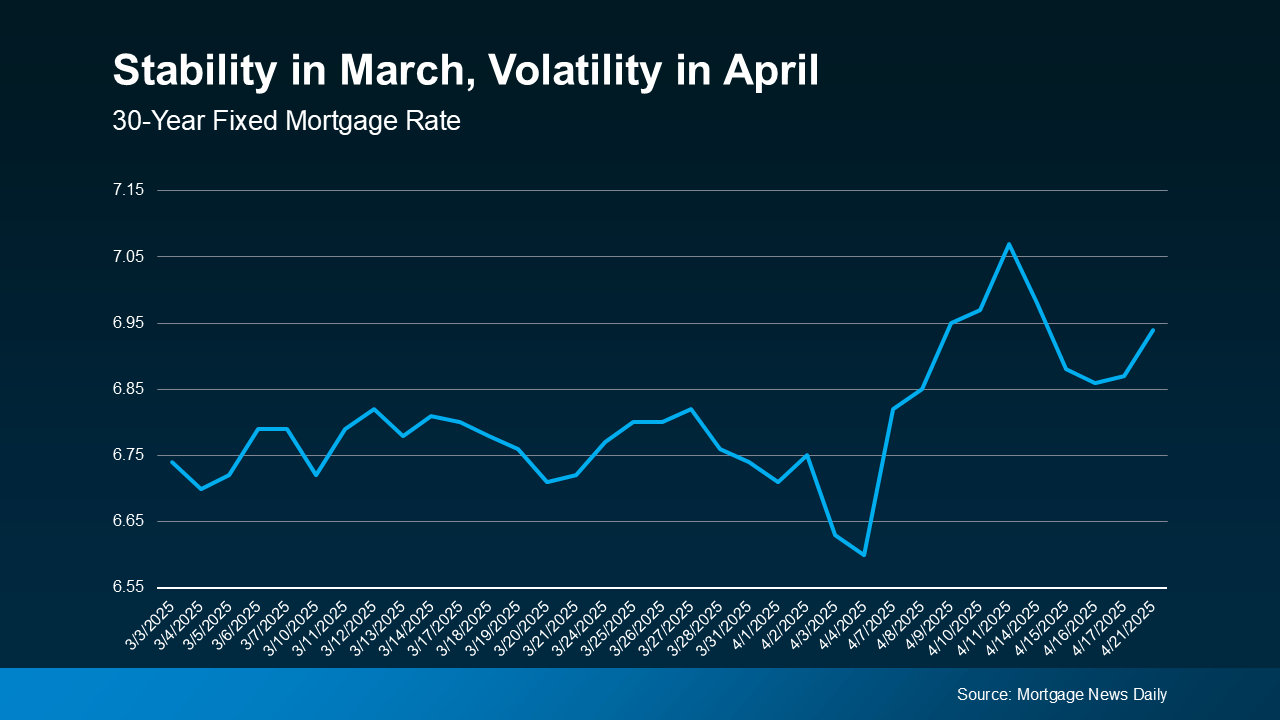

Have you been keeping an eye on mortgage rates lately? If so, you’ve probably noticed they’ve been all over the place. One day they dip slightly, and the next, they’re climbing again. If you’re thinking about buying a home, this kind of movement can feel both confusing and frustrating.

Just take a look at the graph below. It pulls data from Mortgage News Daily and shows how, after a fairly steady March, mortgage rates have taken a noticeable roller coaster ride throughout April:

Mortgage rate fluctuations like we’ve seen recently are normal when the economy is shifting—and that unpredictability is exactly why trying to “time the market” isn’t always the best strategy. You can’t control what happens with mortgage rates, but that doesn’t mean you’re out of options.

Even with economic uncertainty, you do have control over key factors that impact the rate you can get. Focusing on these can put you in a stronger position to secure a great rate when the time comes.

Your Credit Score Matters

Your credit score plays a major role in determining what mortgage rate you’ll qualify for. Even a small bump in your score can make a meaningful difference in your monthly payment. As Bankrate explains:

“Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.”

If you’re unsure where your credit stands or how to improve it, a trusted loan officer can help guide you through the process.

Your Loan Type Can Impact Your Rate

Not all mortgage loans are the same. Different loan types have different eligibility criteria, benefits, and interest rates. The Consumer Financial Protection Bureau (CFPB) explains:

“There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.”

That’s why it’s essential to work with a mortgage expert who can help match you with the right loan for your situation.

Your Loan Term Affects More Than You Think

Loan terms—how long you take to repay your mortgage—also influence your interest rate and overall cost. Freddie Mac explains:

“When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.”

Most buyers choose from 15, 20, or 30-year loan options. Each one has pros and cons, so it’s important to find the term that best aligns with your goals and budget.

Bottom Line

While you can’t predict or control where mortgage rates are headed, you can take proactive steps to improve your financial picture—and put yourself in the best position possible.

Let’s connect so I can introduce you to a trusted lender and help you build a game plan for buying when the time is right for you.

Categories

Recent Posts