Do You Think the Housing Market’s About To Crash? Read This First

Do You Think the Housing Market’s About To Crash? Read This First

Lately, a lot of people seem to be asking the same thing: “Is the housing market about to crash?”

If you’ve been on social media or catching the news, you’ve probably seen some alarming headlines yourself. That’s why it makes sense that, according to Clever Real Estate, 70% of Americans are concerned about a housing crash in 2025.

But before you put your buying or selling plans on hold, take a moment to breathe. The reality is this: the housing market isn’t crashing—it’s shifting. And that shift could actually be to your advantage.

Low Inventory Is Preventing a Market Crash

Mark Fleming, Chief Economist at First American, puts it simply:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

Here’s the idea—when something is in short supply, like concert tickets, prices tend to go up. That’s exactly what’s happening with homes. The inventory just hasn’t caught up with buyer demand, which continues to drive prices higher.

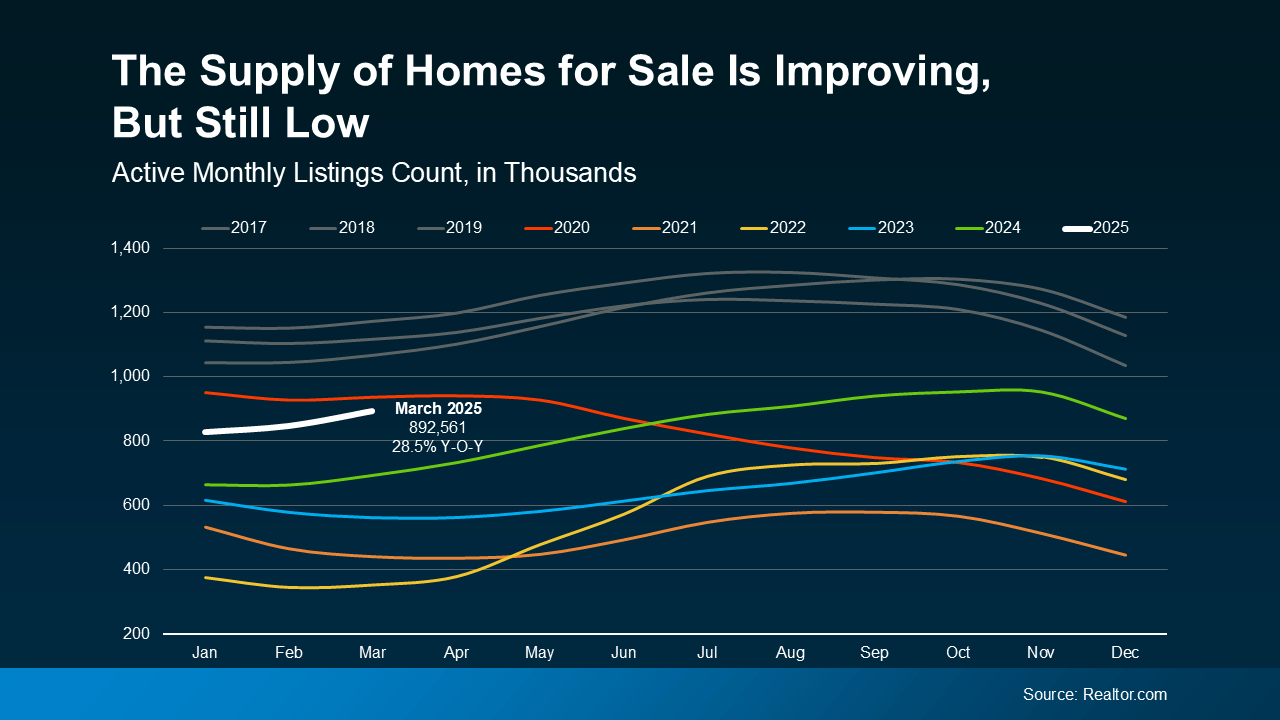

Take a look at the white line for 2025 in the graph below. Even though inventory is increasing, data from Realtor.com shows we’re still far from reaching typical levels, represented by the gray area.

That continued low supply is a key reason why we’re not seeing home prices drop on a national scale. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), puts it:

“… if there’s a shortage, prices simply cannot crash.”

More Homes for Sale Is Slowing Price Growth

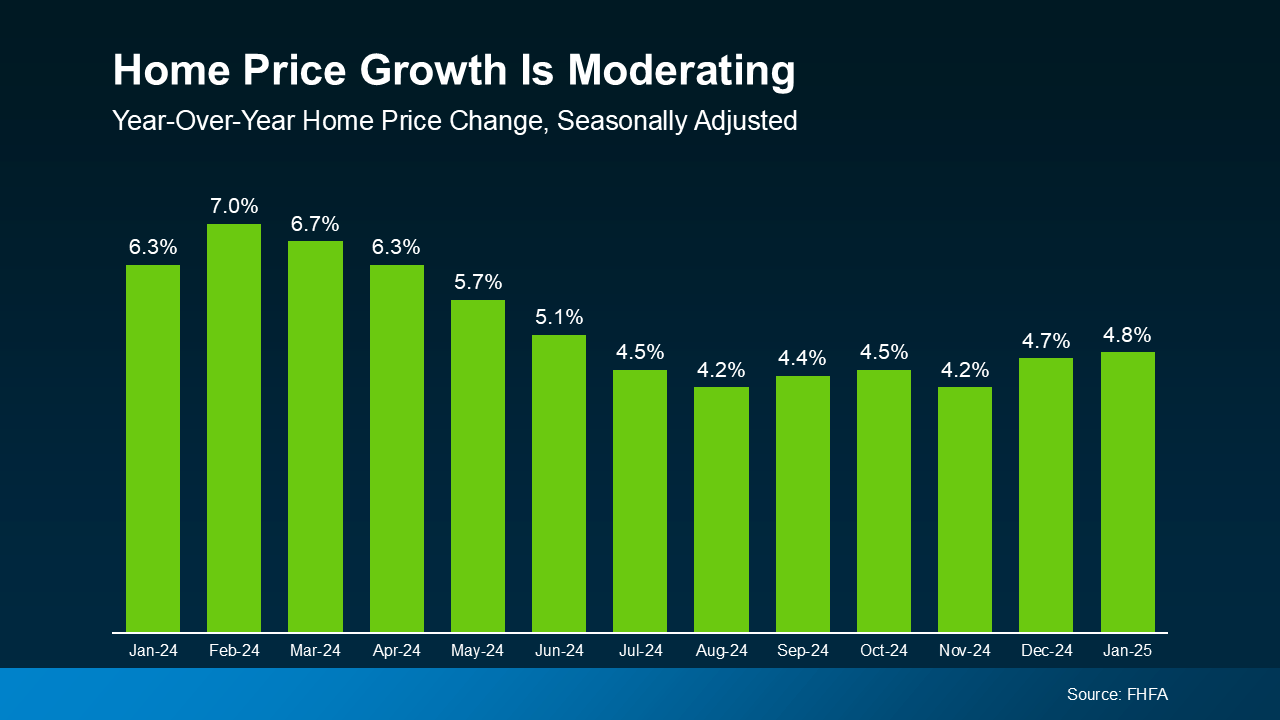

As more homes hit the market, it helps ease some of the pressure that’s been driving prices up—resulting in a more balanced pace of home price appreciation.

So, while home prices aren’t declining across the board, the increase in inventory is helping to slow down how quickly they’re rising. What we’re experiencing now is price moderation (see graph below):

And according to Freddie Mac, that trend of price moderation is expected to continue throughout the rest of the year:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

In simpler terms, home prices are projected to keep rising in most areas, just at a slower, more manageable pace. That’s welcome news if you’ve been struggling with affordability or feeling overwhelmed by the rapid price increases of recent years.

That said, real estate is always local—what’s happening with prices and inventory in one area might look very different in another. That’s why it’s important to connect with a local real estate agent who can give you a clear picture of your specific market.

Bottom Line

Don’t let the headlines create unnecessary fear. Most experts agree that a housing market crash is unlikely in 2025. As Business Insider reports:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

What we’re seeing is a shift toward a more balanced, stable housing market—one with slower price growth and more opportunities for buyers and sellers alike.

Let’s connect and talk about what’s happening in our area and how you can take advantage of today’s evolving market.

Categories

Recent Posts