Focus on Time in the Market, Not Timing the Market

Focus on Time in the Market, Not Timing the Market

Should you buy a home now or should you wait? That’s a big question on many people’s minds today. While the right timing for you will depend on various personal factors, here’s something you may not have considered.

If you’re able to buy at today’s rates and prices, it may be better to focus on time in the market rather than trying to time the market.

The Downside of Trying To Time the Market

Trying to time the market isn’t a good strategy because things can change. Here’s an example: for the better part of this year, projections have indicated that mortgage rates would come down. While experts still agree that lower rates are ahead, shifts in various market and economic factors have delayed the timing of when that’ll happen. Here’s how that’s impacted homebuyers who’ve been sitting on the sidelines. As U.S. News says:

“Those who put off buying a home during the past few years as they were holding out for lower mortgage rates have been left out of the market . . . mortgage rates have stayed higher for longer than previously expected, keeping monthly housing payments elevated. In other words, affordability didn't improve for those who chose to wait.”

This is why timing the market may not pay off if you’re ready and able to buy now.

The Proof Is in the Pudding: How Homeowners Benefit from Rising Home Prices

Delaying your plans also means missing out on the equity you’d gain if you went ahead with your purchase today. The potential equity gains at stake may surprise you.

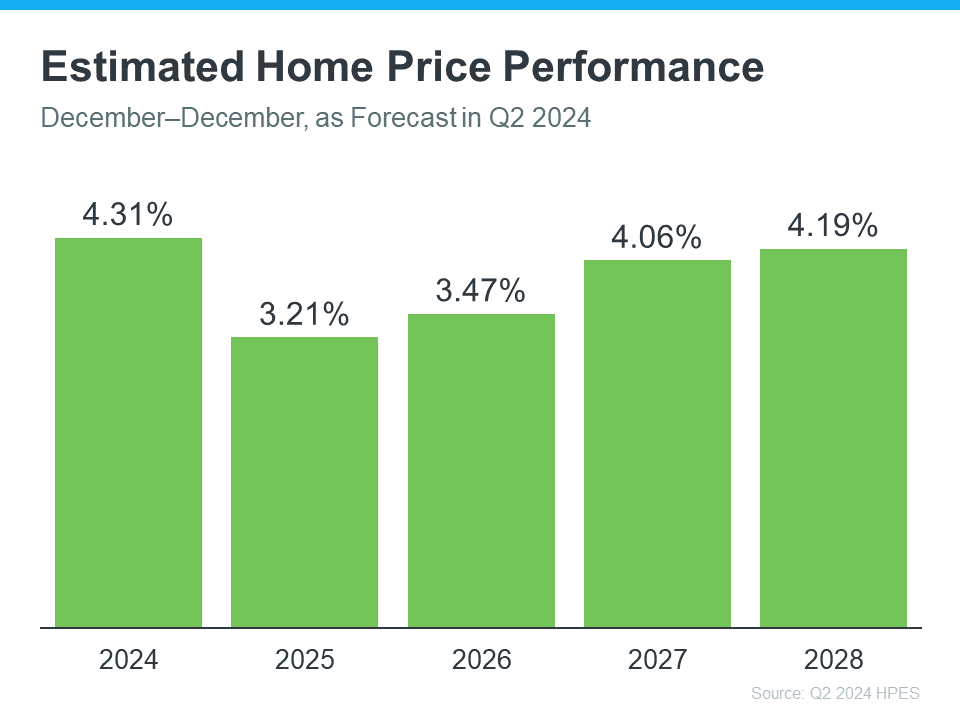

Each quarter, Fannie Mae releases the Home Price Expectations Survey. It asks over one hundred economists, real estate experts, and investment and market strategists to forecast home prices over the next five years. In the latest release, experts project that home prices will continue to rise through at least 2028 (see the graph below):

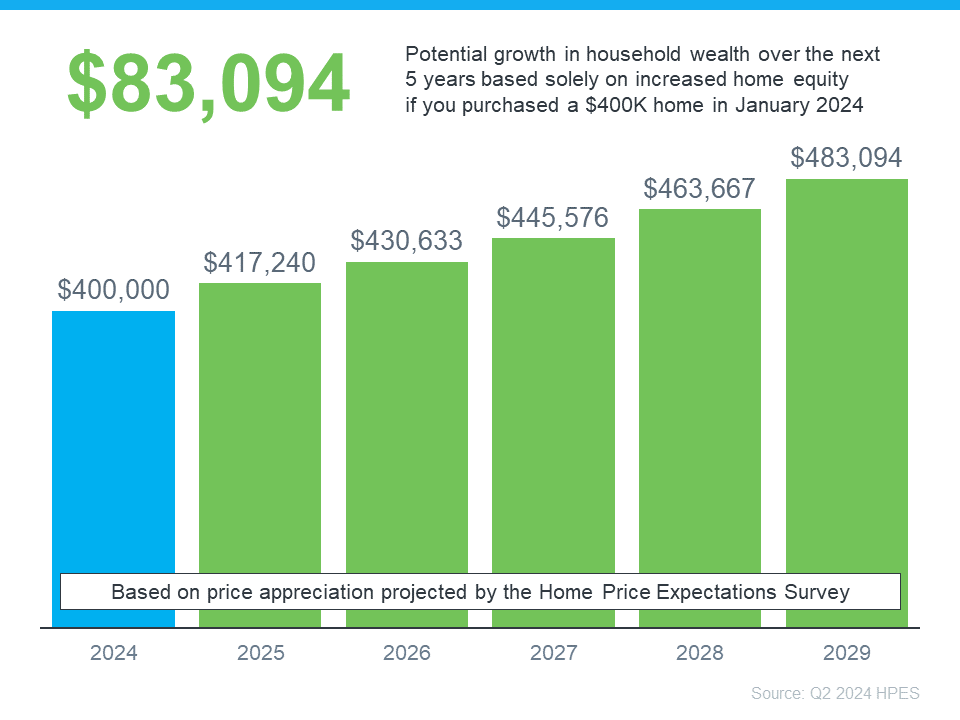

To put these numbers in context, let’s look at a breakdown of what you stand to gain once you buy. The graph below uses a typical home's value to illustrate how a home could appreciate over the next few years based on those HPES projections:

To put these numbers in context, let’s look at a breakdown of what you stand to gain once you buy. The graph below uses a typical home's value to illustrate how a home could appreciate over the next few years based on those HPES projections:

In this example, let’s say you bought a $400,000 home at the beginning of this year. Based on the expert forecasts from the HPES, you could gain more than $83,000 in household wealth over the next five years. That’s not a small number.

This data illustrates why time in the market really matters.

The Advice You Need To Hear If You’re Ready and Able To Buy Now

Right now, you may be focused on what’s happening with mortgage rates and how those impact your monthly payment, but don’t forget to factor in home prices.

Prices are expected to continue climbing, albeit at a more moderate pace. While a moderate rise in prices may not seem ideal now, once you own a home, that growth will be a significant advantage. This is the "time in the market" aspect.

Sure, you could try timing the market, but the equity you’ll be missing out on in the meantime is something to seriously consider. If you’re ready and able to buy now, you need to decide: is it really worth waiting?

Rather than focusing on timing the market. It’s better to have time in the market.

As U.S. News Real Estate sums up:

“There's never a one-size-fits-all answer to whether now is the right time to buy a home. . . . There's also no way to predict precisely what the market will do in the near future . . . Perfectly timing the market shouldn't be the goal. This decision should be determined by your personal needs, financial means and the time you have to find the right home.”

Bottom Line

If you’re debating whether to buy now or wait, remember it’s time in the market, not timing the market, that makes the difference. If you want to get the ball rolling and set yourself up for those significant equity gains, let’s connect to make it happen.

Categories

Recent Posts

GET MORE INFORMATION