What To Look For From This Week’s Fed Meeting

What To Look For From This Week’s Fed Meeting

You might be hearing a lot about the Federal Reserve (the Fed) and how its actions could affect the housing market at this time. Here’s the reason.

The Fed is scheduled to meet again this week to determine the next move regarding the Federal Funds Rate, which is the cost for banks to borrow from each other. While this rate doesn’t directly set mortgage rates, it can influence them. If you’re considering buying or selling a home, you might be curious about the potential impact and when mortgage rates might decrease.

Here’s a brief overview of what you need to know to anticipate what’s coming next. The Fed’s decisions are based on three key economic indicators:

- The Direction of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Let’s take a look at each one.

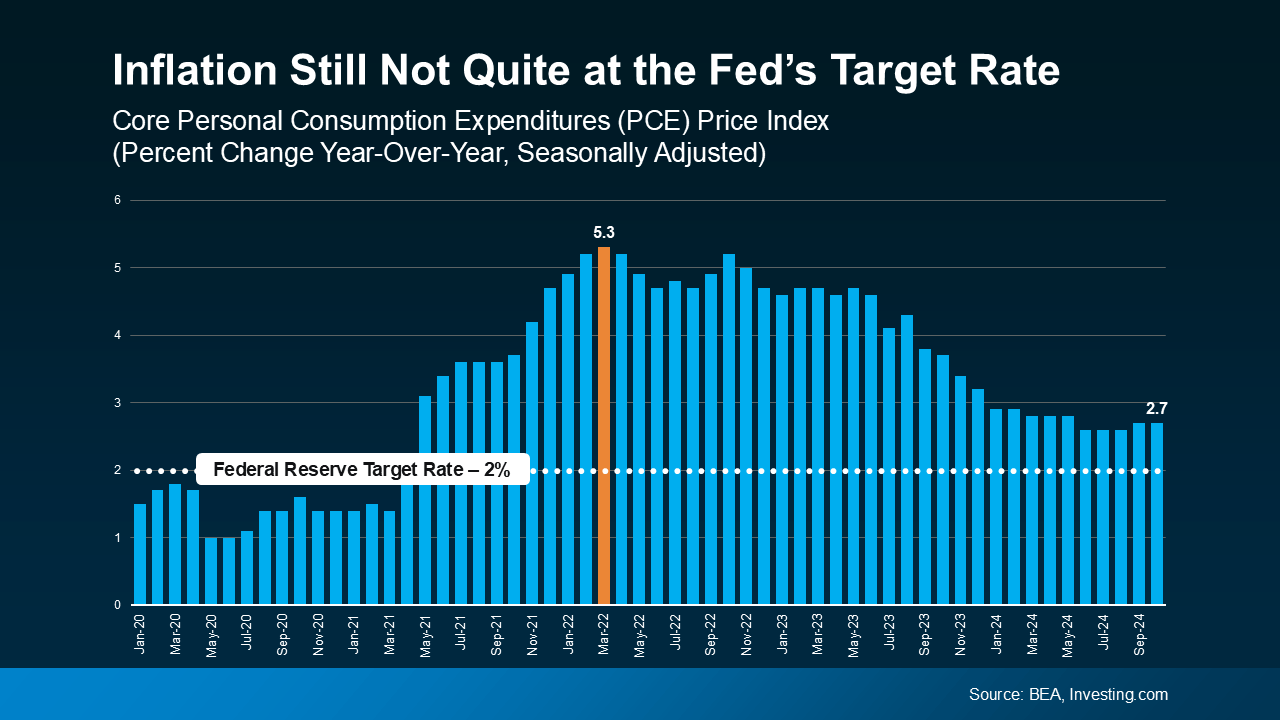

1. The Direction of Inflation

You've probably observed that the cost of everyday items and services has been rising with each shopping trip. This increase is due to inflation, which the Federal Reserve aims to reduce to its 2% target.

Currently, inflation remains above this goal. However, despite some fluctuations, it has been trending downward over the past two years and is now relatively stable, as illustrated in the graph below:

The Federal Reserve is expected to reduce the Federal Funds Rate this week to make borrowing more affordable, aiming to stimulate economic growth while keeping inflation in check.

The Federal Reserve is expected to reduce the Federal Funds Rate this week to make borrowing more affordable, aiming to stimulate economic growth while keeping inflation in check.

2. How Many Jobs the Economy Is Adding

The Federal Reserve is closely monitoring monthly job additions to the economy. They aim for a slight deceleration in job growth before further reducing the Federal Funds Rate. A slowdown in job creation indicates a healthy yet gradually cooling economy, aligning with their objectives. This trend is currently observed, as reported by Reuters:

“Any doubts the Federal Reserve will go ahead with an interest-rate cut . . . fell away on Friday after a government report showed U.S. employers added fewer workers in October than in any month since December 2020.”

Employers continue to hire, but at a reduced pace, indicating a cooling job market after a period of rapid growth. This slowdown aligns with the Federal Reserve's goal of moderating economic expansion to maintain stability.

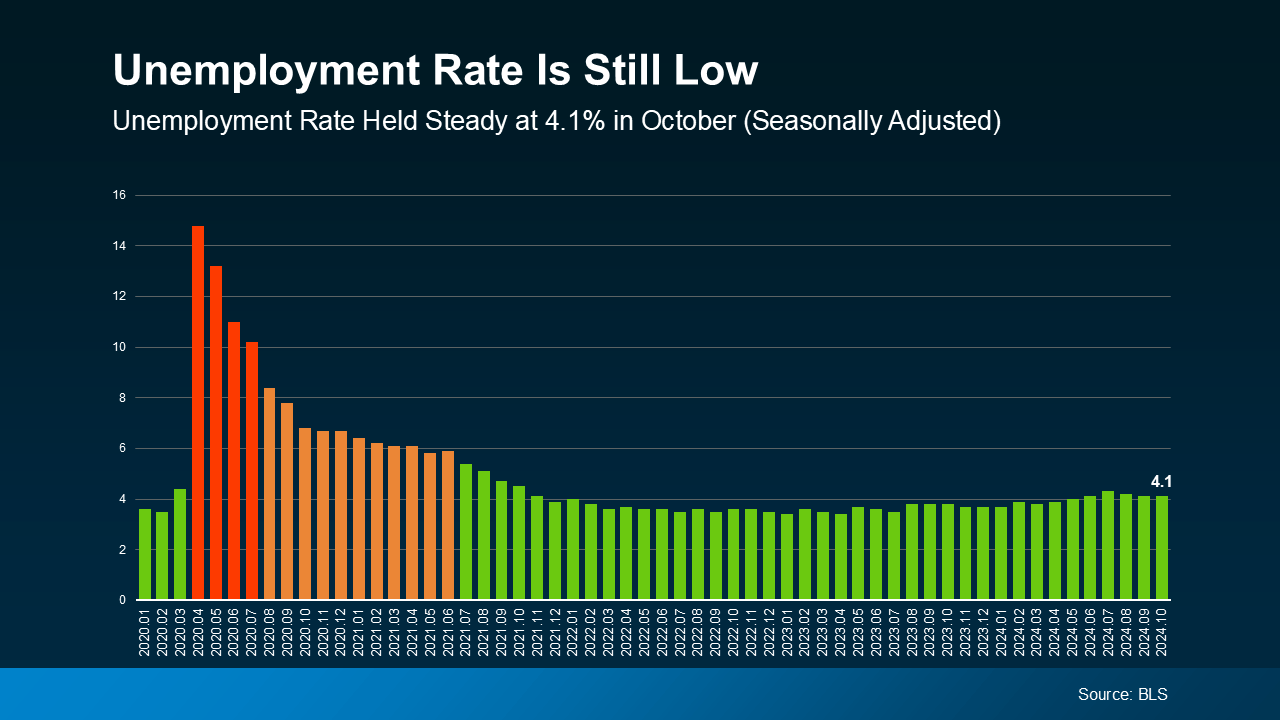

3. The Unemployment Rate

The unemployment rate indicates the proportion of individuals actively seeking employment but unable to find work. A low unemployment rate suggests that most people are employed, which is positive. However, it can also contribute to higher inflation, as increased employment leads to more spending, potentially driving prices up.

Many economists view an unemployment rate below 5% as approaching full employment in practical terms. The latest data shows the unemployment rate at 4.1%.

Unemployment this low shows the labor market is still strong even as fewer jobs were added to the economy. That’s the balance the Fed is looking for.

Unemployment this low shows the labor market is still strong even as fewer jobs were added to the economy. That’s the balance the Fed is looking for.

What Does This Mean Going Forward?

The economy is largely moving in the direction the Fed aims for, which is why many experts predict a likely quarter-point cut in the Federal Funds Rate this week, as indicated by the CME FedWatch Tool.

If this prediction holds, it may also open the door for mortgage rates to decrease. However, this won’t happen overnight; it will take time. Keep in mind, the Fed doesn’t set mortgage rates directly. Projections indicate that as long as economic indicators remain favorable and the Fed continues its planned rate reductions through 2025, mortgage rates should gradually decline over the next year.

However, any shifts in these factors could lead to changes in the market and influence the Fed’s approach in the coming days and months. Expect some market fluctuations, with mortgage rates adjusting along the way. As Ralph McLaughlin, Senior Economist at Realtor.com, highlights:

"The trajectory of rates over the coming months will be largely dependent on three key factors: (1) the performance of the labor market, (2) the outcome of the presidential election, and (3) any possible reemergence of inflationary pressure. While volatility has been the theme of mortgage rates over the past several months, we expect stability to reemerge towards the end of November and into early December."

Bottom Line

Although the Fed’s actions have an influence, mortgage rates are primarily driven by economic data and market conditions. As we progress through the remainder of 2024 and into 2025, we can anticipate rates to either stabilize or gradually decrease, bringing a bit more predictability to an otherwise volatile market.

Categories

Recent Posts