Is a Fixer Upper Right for You?

Is a Fixer Upper Right for You?

Are you looking to buy a home but feeling like almost everything is out of reach? Here’s the good news: there’s still a path to homeownership, even when affordability feels like a significant hurdle—and it might just be through a fixer-upper. Let’s explore why purchasing a fixer-upper could be your ticket to homeownership and how you can make it work.

What Is a Fixer Upper?

A fixer-upper is a home that is livable but requires some renovations. The extent of the work needed can vary by property—some may only need cosmetic updates like removing wallpaper and installing new flooring, while others might require more significant repairs such as a new roof or plumbing updates.

Because these homes require some effort to improve, they typically come with a lower price tag based on local market value. In fact, a survey from StorageCafe indicates that fixer-uppers usually cost about 29% less than move-in-ready homes.

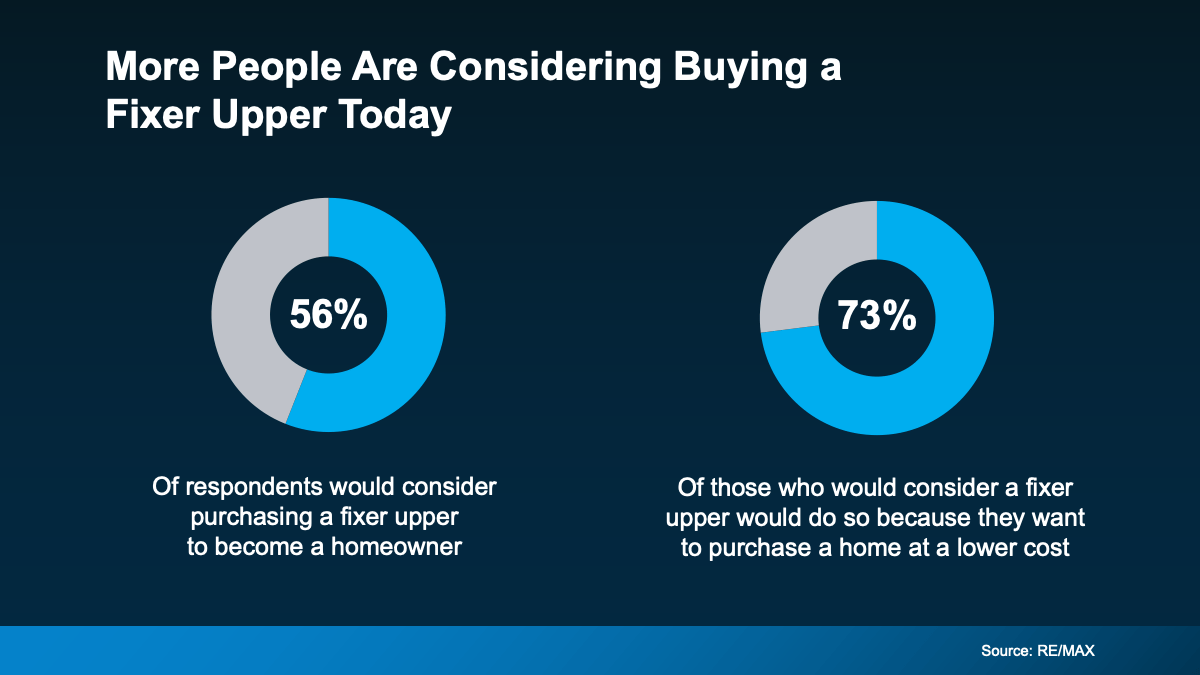

This is why, according to a recent survey, more buyers are currently considering homes that need a bit of extra work (see below):

If you’re seeking a way to get your foot in the door and are open to putting in some effort, a house with untapped potential could be a great option.

If you’re seeking a way to get your foot in the door and are open to putting in some effort, a house with untapped potential could be a great option.

Tips for Buying a Home That Needs Some Work

Before you purchase a home that may need some renovations, here are a few things to consider:

- Choose a Good Location: You can renovate a house, but you can’t change its location. Ensure that the home is situated in a neighborhood you like or in an area with rising property values and an increasing number of local amenities. This way, even after you invest money in repairs, the house will appreciate in value over time.

- Budget for Surprises: Renovating a house can require more time and money than you anticipate. Be sure to allocate some of your budget for unexpected repairs or other surprises that may arise during the renovation process.

- Get a Home Inspection: Before making a purchase, hire an inspector to evaluate the house. They can identify the necessary repairs, helping you avoid costly surprises down the line.

- Plan Your Priorities: When deciding what to tackle first, it’s helpful to categorize your goals. Consider your home in three categories: must-haves (essential repairs), nice-to-haves (upgrades that would enhance your living experience), and dream-state features (luxuries you can add later). This approach will assist you in prioritizing tasks and sticking to your budget.

Remember, the perfect home is the one you perfect after buying it. Starting with a fixer-upper gives you the chance to customize a home to your preferences while saving money on the initial purchase price. With careful planning, budgeting, and a bit of vision, you can transform a house that needs some work into your ideal home.

Real estate agents excel at identifying homes with potential. They understand the local market and can direct you to properties where smart upgrades can increase value. With their assistance, you’re more likely to find a house that aligns with your overall budget and offers opportunities for meaningful improvements.

Bottom Line

In today’s market, where the cost of homeownership can be daunting, finding a move-in-ready home that fits your budget can seem like a significant challenge. However, if you’re willing to invest some effort, you can gradually transform a fixer-upper into your ideal home. Let’s explore the possibilities and discover a place that will work for you.

Categories

Recent Posts