How Home Equity Can Help Fuel Your Retirement

How Home Equity Can Help Fuel Your Retirement

If you're approaching retirement, it's crucial to start planning for your next chapter, ensuring you have the financial comfort to enjoy the lifestyle you desire.

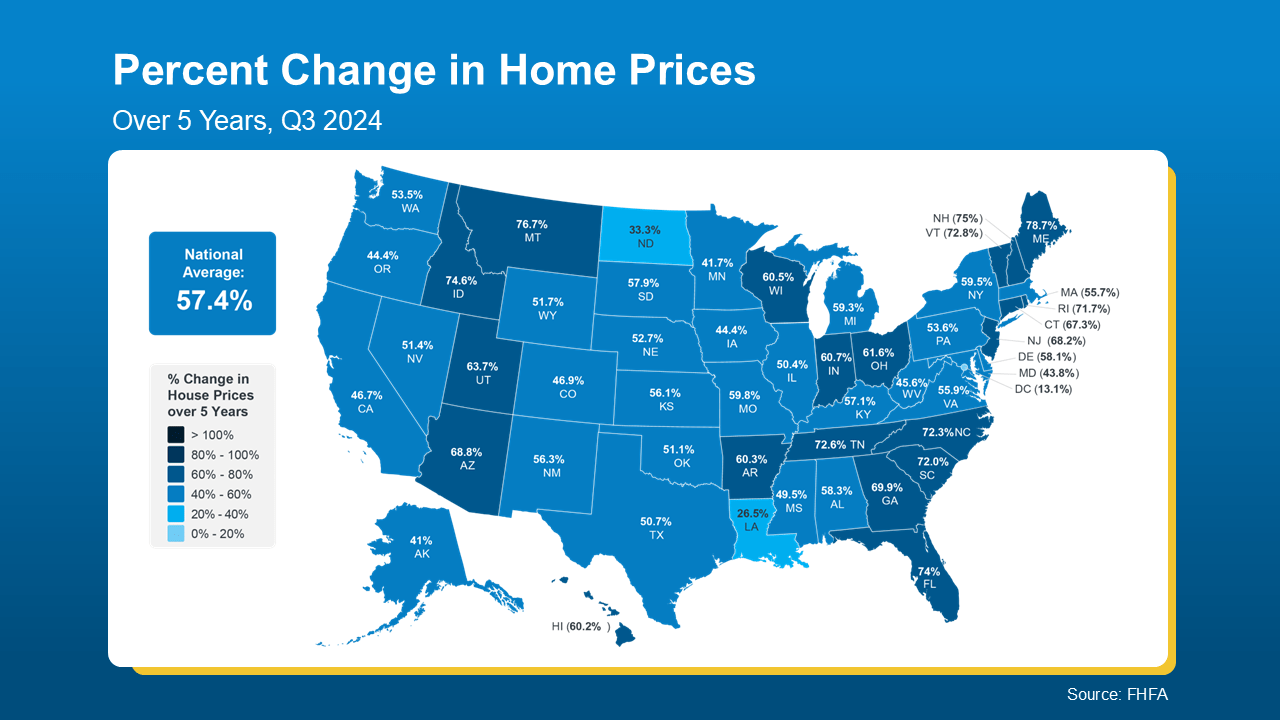

One significant asset you might not have considered is your home. According to data from the Federal Housing Finance Agency (FHFA), home values have increased by nearly 60% over the past five years. This substantial growth in home equity represents a potential source of funds that could support your retirement plans (see graph below for detailed trends):

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

“ . . . Boomer overall wealth increased by $19 trillion, or $486,000 per household, half of which is due to house price appreciation.”

If you've owned your home for longer than five years, it's likely that the equity you've built up is even greater. If you're looking to tap into the wealth accumulated over the years, considering selling your house to downsize could be a wise decision. This move can provide you with more financial flexibility and security in retirement.

Why Downsizing Might Be the Right Move

Selling your current home to downsize to a smaller property or to move to a more affordable area can release a significant portion of your home equity. This can provide you with additional funds to help ensure a comfortable retirement. Whether your retirement plans include traveling, spending more time with family, or simply enhancing your financial security, accessing the equity built up in your home can substantially impact your ability to enjoy your later years. As Chase notes:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Here are just a few of the ways a smaller home can fuel your retirement:

1. Cut Your Cost of Living

Data from the AARP indicates that the primary reason adults aged 50 and older choose to move is to reduce their cost of living. Downsizing to a smaller home or moving to a more affordable area can significantly lower monthly expenses, such as utilities, property taxes, and maintenance costs. This financial relief can be crucial for those entering retirement, helping to stretch retirement savings further and improve overall financial security.

2. Simplify Your Life

A smaller home typically requires less maintenance and comes with fewer responsibilities, freeing up your time and energy to focus on what truly matters to you in retirement. This shift can enhance your quality of life, allowing you to dedicate more time to hobbies, travel, family, and other pursuits that you value in your retirement years.

3. Boost Your Financial Flexibility

Selling your current house allows you to access the equity you've built up, converting it into cash that you can use in various ways. Whether it’s for investing, paying off debts, or establishing a financial safety net, tapping into this equity can significantly enhance your financial flexibility and open up new opportunities for your future.

The First Step Toward Your Next Chapter

If you're considering downsizing, the next step is to consult with a real estate agent. Your agent will help you assess how much equity you have in your current home and explore ways to utilize it effectively. However, their role extends beyond just financial advice. They'll also guide you through the entire process of selling your existing home and finding a new one, ensuring a smooth transition to both a new living situation and a new phase in life. This comprehensive support can make the downsizing journey less stressful and more successful.

Bottom Line

If you're aiming to retire in 2025, now could be the ideal time to consider downsizing and accessing the equity built up in your home. Starting your planning now will ensure that you're well-prepared for retirement, setting the stage for a future where every day can feel as leisurely and enjoyable as a Saturday. Let’s connect and begin planning your move to help you transition smoothly into this exciting new chapter of your life.

Categories

Recent Posts