How To Buy a Home Without Waiting for Lower Rates

How To Buy a Home Without Waiting for Lower Rates

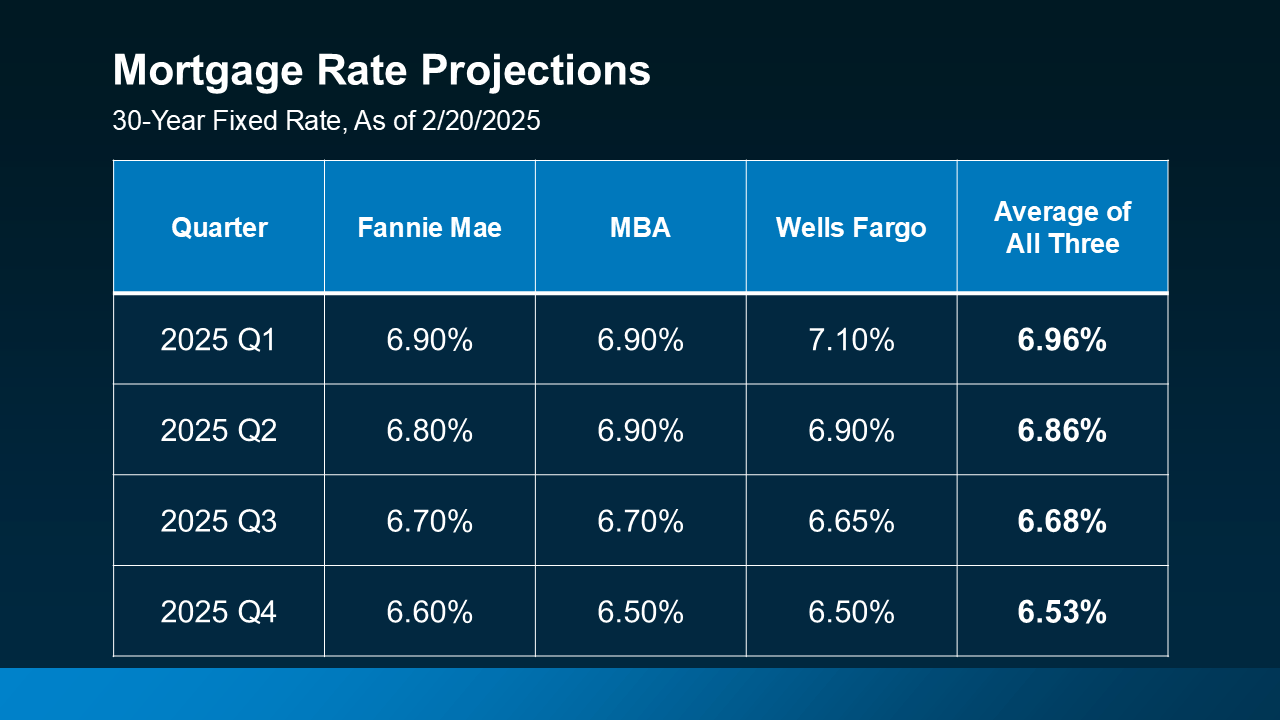

Many prospective homebuyers are holding out for mortgage rates to drop, but current forecasts suggest only modest declines. While some had hoped rates would fall below 6% by year's end, updated predictions indicate that might not be the case.

Projected Rate Changes: Earlier expectations had mortgage rates dipping below 6%, but recent analyses from sources like Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo suggest a stabilization around 6.5% to 7% for the foreseeable future.

Though rates may not decrease as significantly as many would like, there are still strategies to make home buying more affordable, even in a higher rate environment.

If you're delaying buying a home in anticipation of significantly lower mortgage rates, you might be waiting longer than expected. Life changes like a new job, a baby, or a marriage might necessitate a quicker move.

Creative Financing Options in Today’s Market

Given that rates are unlikely to drop as much as some might hope, exploring alternative financing options could be a wise move to help you purchase a home sooner. Here are three strategies to consider discussing with your lender:

-

Mortgage Buydowns A mortgage buydown involves paying an upfront fee to reduce your mortgage rate for a specific period, often making initial payments more affordable. This option is becoming popular among first-time buyers who are looking for ways to lower their monthly expenses in the early years of homeownership.

-

Adjustable-Rate Mortgages (ARMs) ARMs start with a lower rate than traditional fixed mortgages, which can be advantageous, particularly if you plan on moving or refinancing before the rate adjusts. Modern ARMs are structured more safely than those available before the housing crash, with built-in limits on how much and how often the rate can change.

As Lance Lambert, Co-Founder of ResiClub, points out, today's ARMs are designed to be much safer than the ones from the past, reducing the risks historically associated with this type of loan.

These alternative financing options can offer flexibility and potentially lower costs, depending on your financial situation and future plans. Discussing these options with a lender can help you make an informed decision that aligns with your homebuying goals and financial circumstances.

“. . . ARM products today are different from many of the products issued in the mid-2000s. Before 2008, lenders often approved ARMs based on borrowers ability to pay the initial lower interest rates. And sometimes they didn’t even check that (remember Ninja loans). Today, adjustable-rate borrowers qualify based on their ability to cover a higher monthly payment, not just the initial lower payment.”

Banks have significantly tightened lending practices compared to the past. Today, they meticulously verify an applicant's income, assets, and employment status before approving loans, especially adjustable-rate mortgages (ARMs). This rigorous vetting process reduces the risks once associated with ARMs.

3. Assumable Mortgages

Another interesting option is an assumable mortgage, which allows you to take over the seller’s existing mortgage along with its potentially lower rate. With over 11 million homes potentially qualifying for assumable mortgages, this could be a viable option if you're seeking more favorable financing terms.

Bottom Line

Holding out for a substantial drop in mortgage rates may not be the most practical approach. Alternative strategies such as mortgage buydowns, ARMs, and assumable mortgages could facilitate more immediate and affordable homeownership. Discussing these options with a local lender can help you understand what might work best for your financial situation and homebuying goals.

How do these options shape your plans for buying a home this year?

Categories

Recent Posts