Is Affordability Starting To Improve?

Is Affordability Starting To Improve?

Over the past couple of years, many people have struggled to buy a home. While affordability remains tight, there are signs that it's getting a bit better and may continue to improve throughout the rest of the year. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Housing affordability is improving ever so modestly, but it is moving in the right direction.”

Here’s a look at the latest data on the three biggest factors affecting home affordability: mortgage rates, home prices, and wages.

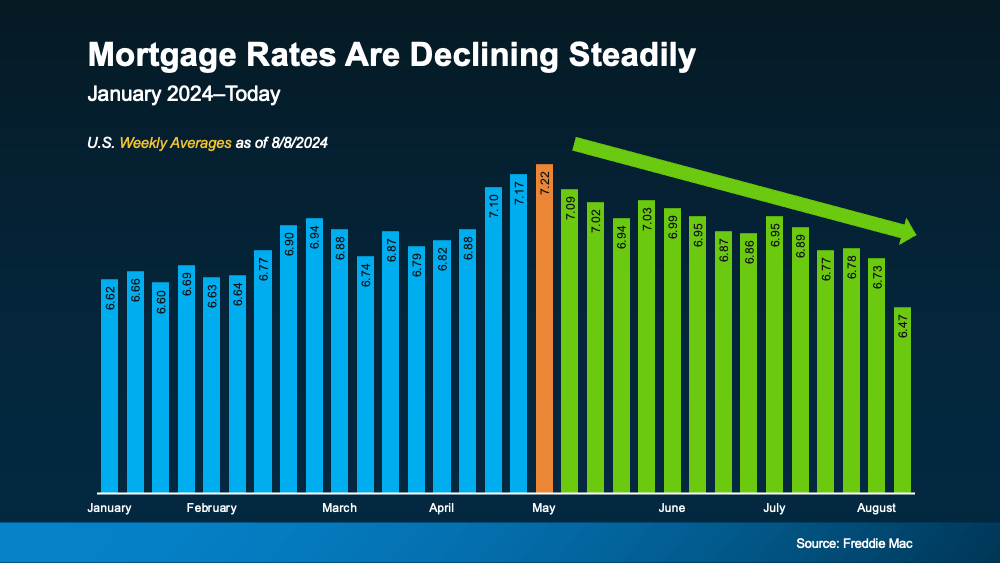

1. Mortgage Rates

Mortgage rates have been volatile this year, fluctuating between the mid-6% to low 7% range. However, there's some good news. Data from Freddie Mac shows that rates have been trending down overall since May (see graph below):

Mortgage rates have improved lately, partly due to recent economic, employment, and inflation data. While some rate volatility is still expected moving forward, experts suggest that if economic data continues to show signs of cooling, mortgage rates could keep decreasing.

Even a small drop in rates can be beneficial. Lower rates make it easier to afford the home you want by reducing your monthly payment. However, it’s important not to expect rates to drop back down to 3%.

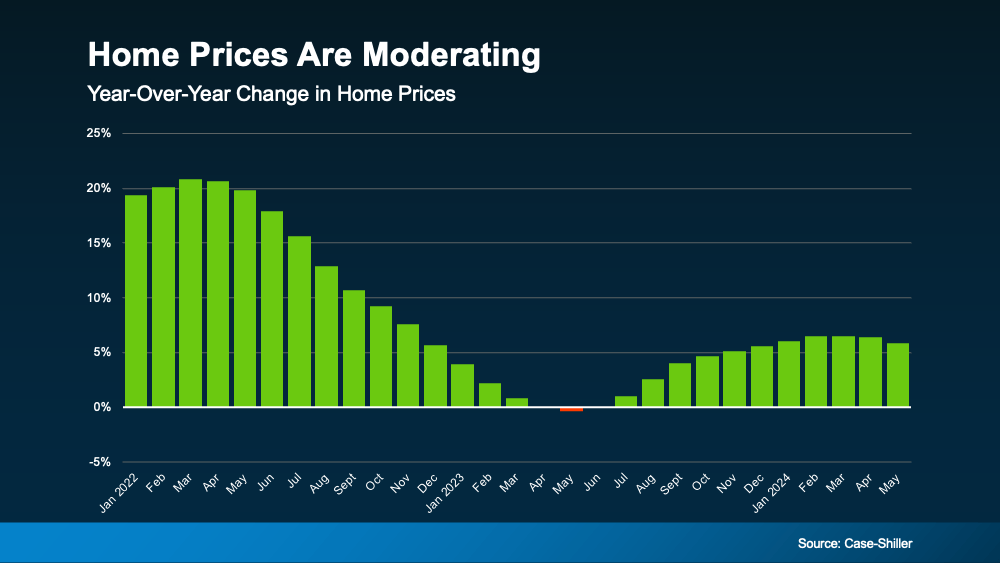

2. Home Prices

The second major factor to consider is home prices. Nationally, they’re still increasing this year, but not as rapidly as they did a couple of years ago. The graph below, using home price data from Case-Shiller, illustrates this trend:

If you're thinking about buying a home, slower price growth is good news. Home prices surged during the pandemic, making it challenging for many people to buy. Now, with prices rising more slowly, buying a home may feel more attainable. As Odeta Kushi, Deputy Chief Economist at First American, says:

If you're thinking about buying a home, slower price growth is good news. Home prices surged during the pandemic, making it challenging for many people to buy. Now, with prices rising more slowly, buying a home may feel more attainable. As Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help – so the dream of homeownership isn’t boarded up just yet.”

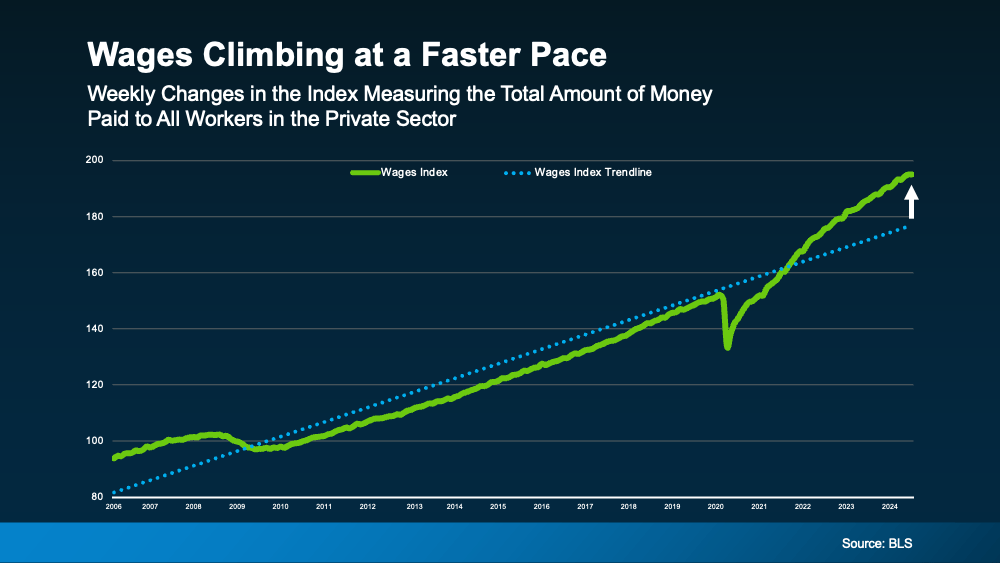

3. Wages

Another factor contributing to improved affordability is rising wages. The graph below, using data from the Bureau of Labor Statistics (BLS), shows how wages have increased over time:

Look at the blue dotted line; it shows how wages typically increase in a normal year. On the right side of the graph, you'll notice wages are rising even faster than usual—that's the green line.

This benefits you because as your income increases, it becomes easier to afford a home. With a higher income, you won’t have to allocate as much of your paycheck toward your monthly mortgage payment.

Bottom Line

When you consider all these factors together—mortgage rates trending down, home prices rising more slowly, and wages increasing faster than usual—you'll see early signs that affordability might be starting to improve, even though it's still a challenge.

Categories

Recent Posts