Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage rates have reached their lowest level in over a year and a half, which is significant news for those who have been waiting on the sidelines to buy a home.

Even a slight decrease in rates can lead to a more favorable monthly payment than you might expect for your next home. The recent drop is quite substantial. As Sam Khater, Chief Economist at Freddie Mac, notes:

“Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.”

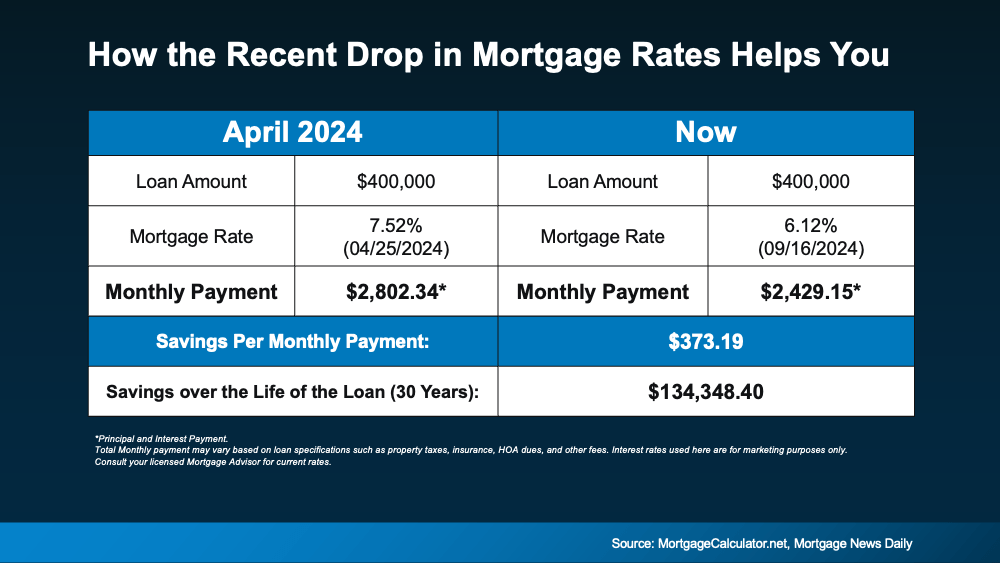

If you want to see the impact for yourself, here’s how the math breaks down. Let’s take a closer look at how your monthly payment would be affected.

The chart below illustrates what a monthly payment (principal and interest) would be on a $400K home loan if you purchased a house back in April (when mortgage rates were at their highest this year) compared to what it could look like if you buy a home now (see below):

Shifting from 7.5% just a few months ago to the low 6s significantly affects your finances. In that short time, the expected monthly payment on a $400K loan has decreased by over $370. That’s a reduction of hundreds of dollars each month.

Shifting from 7.5% just a few months ago to the low 6s significantly affects your finances. In that short time, the expected monthly payment on a $400K loan has decreased by over $370. That’s a reduction of hundreds of dollars each month.

Bottom Line

With the recent decrease in mortgage rates, your purchasing power is currently stronger than it has been in nearly two years. Let’s discuss your options and how you can make the most of this moment you’ve been waiting for.

Categories

Recent Posts

GET MORE INFORMATION