Two Reasons Why the Housing Market Won’t Crash

Two Reasons Why the Housing Market Won’t Crash

“A housing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

Keeping that definition in mind, here are two reasons why this isn't likely to happen anytime soon.

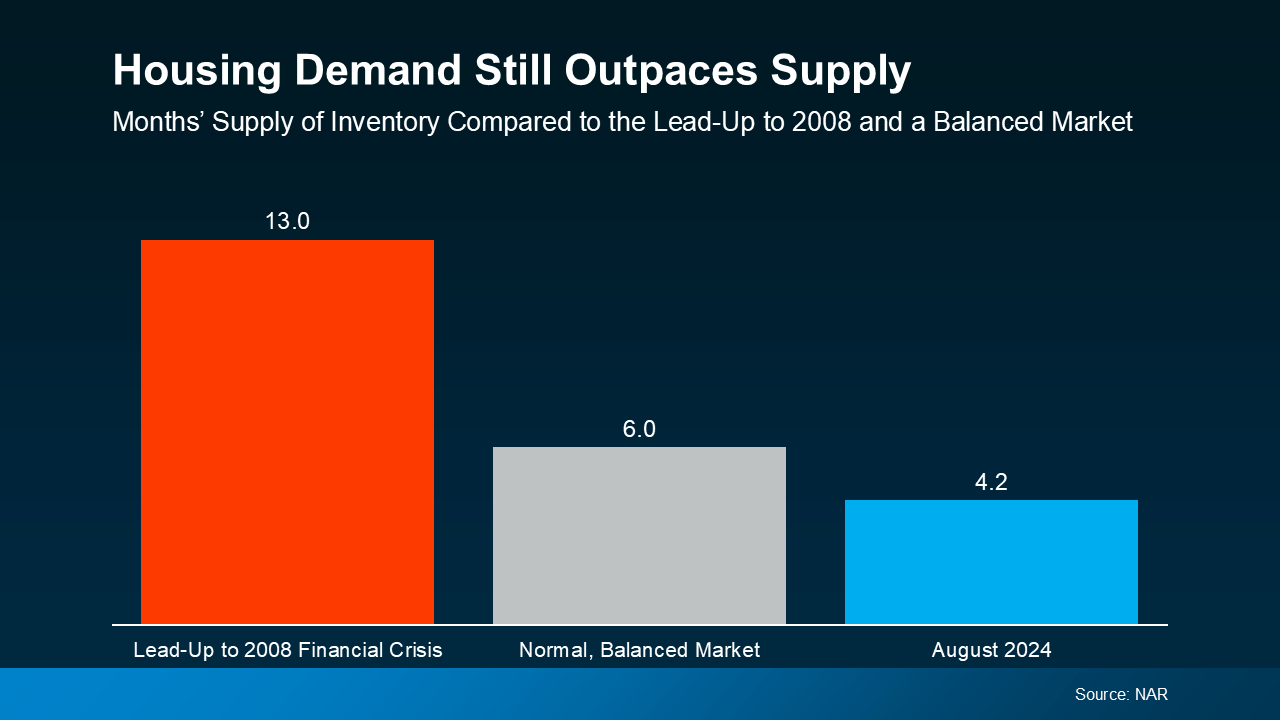

1. Demand for Homes Is Higher than Supply

One of the primary reasons the housing market crashed in 2008 was an oversupply of homes. However, today’s situation is quite different.

A general rule of thumb is that a balanced market has a six-month supply of homes. A higher number indicates that supply exceeds demand, while a lower number suggests that demand surpasses supply. The graph below uses data from NAR to provide context for today’s market conditions:

The graph compares housing supply across three different time periods. The red bar indicates there were 13 months of supply before the 2008 crisis, which was excessively high. The gray bar represents a balanced market with six months of supply for context. The blue bar shows that there are currently only 4.2 months of supply.

In simple terms, there are more buyers looking for homes than there are homes available to buy right now. This means that demand is greater than supply. When this occurs, home prices tend to remain stable or even rise—the opposite of a housing market crash.

It's important to recognize that inventory levels vary from one market to another. Some areas may have a more balanced supply, while others might experience a slight oversupply, which can affect local prices. However, most markets are still facing a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), states:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

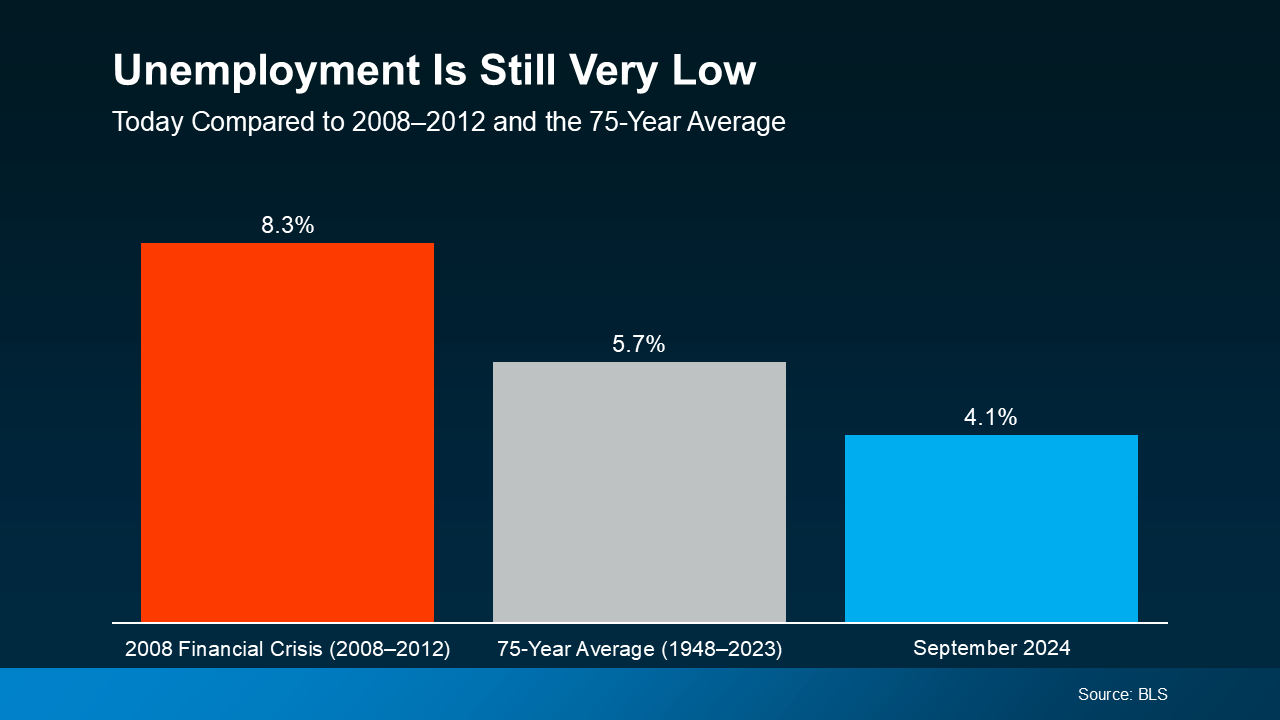

2. Unemployment Is Still Low

When people are unemployed, they are more likely to struggle with their mortgage payments, which can lead to selling or facing foreclosure. This was a significant issue during the 2008 financial crisis. However, today, the employment situation is much more stable (see graph below):

Once again, this graph illustrates three different time periods, but this one focuses on the unemployment rate. The red bar indicates the 2008 financial crisis, during which unemployment was very high at 8.3%. The gray bar represents the 75-year average of 5.7%. The blue bar shows the current unemployment rate, which is significantly lower at just 4.1%.

At present, people are working, earning an income, and making their mortgage payments. This stability is one reason why the wave of foreclosures seen in 2008 is unlikely to occur again. Additionally, with so many people employed right now, many are in a position to buy a home, which continues to exert upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s natural to feel concerned when discussions of a recession and economic uncertainty arise, it’s important to recognize that the housing market is in a far better position than it was in 2008. According to Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

The demand for homes continues to exceed supply, and unemployment remains low. These are two critical factors that will help prevent the housing market from crashing anytime soon.

Bottom Line

The housing market is significantly stronger than it was in 2008, but it's essential to keep in mind that real estate is highly localized.

Therefore, staying informed about our specific market is always a wise approach. If you have any questions or would like to discuss how these factors are affecting our area, don’t hesitate to reach out.

Categories

Recent Posts