Here’s What a Recession Could Mean for the Housing Market

Here’s What a Recession Could Mean for the Housing Market

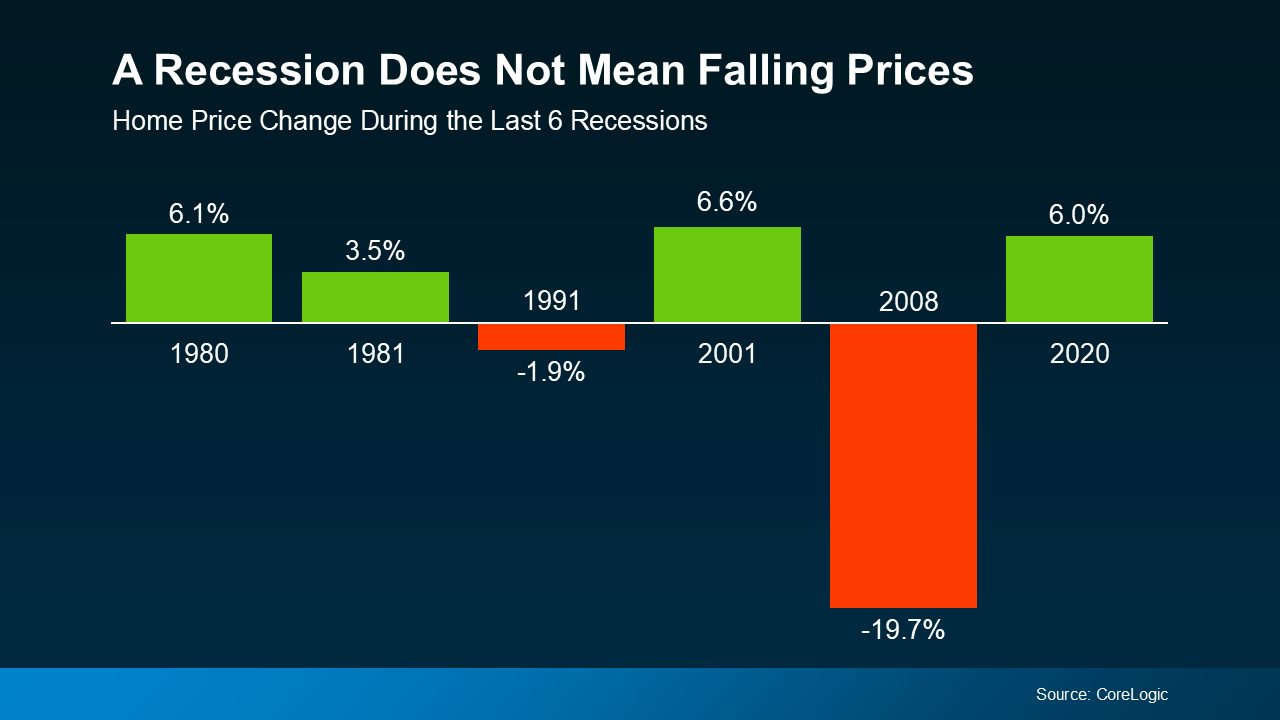

It's a common misconception that a recession automatically leads to falling home prices, largely due to the dramatic events of 2008. However, historical trends show that this isn't necessarily the case. Examining data from CoreLogic, we see that during four of the last six recessions, home prices have actually increased. This indicates that each economic downturn has its unique factors influencing the housing market, and a recession does not automatically result in lower home prices.

If you're considering entering the housing market, it's important not to jump to conclusions about recessions driving down home prices. Historically, home prices have continued on their existing trends during most recessions, with increases observed in many cases. Currently, home prices are still on an upward trend, though at a steadier rate.

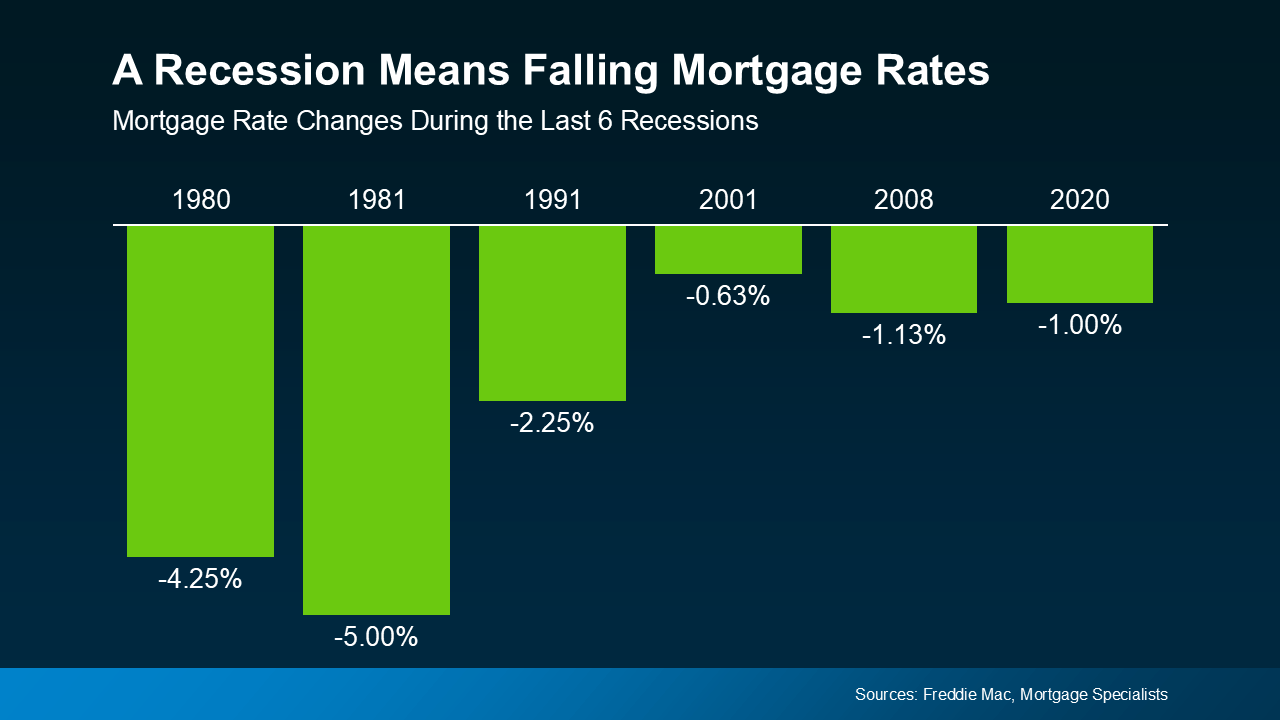

Additionally, mortgage rates often decrease during recessions, which could be beneficial for buyers. Data from the last six recessions show that mortgage rates consistently dropped, potentially making it a favorable time for financing a home purchase.

If a recession occurs, it might lead to lower mortgage rates, though it's unlikely they would drop as low as 3% again. However, understanding the history can alleviate some concerns about the housing market during economic downturns.

Bottom Line

While the possibility of a recession is increasing, it's important to rely on historical trends to gauge potential impacts on the housing market. Do you have specific concerns or questions about how a recession could affect your plans to buy or sell a home? Let's discuss how you can navigate these uncertainties.

Categories

Recent Posts