Buying Beats Renting in 22 Major U.S. Cities

Buying Beats Renting in 22 Major U.S. Cities

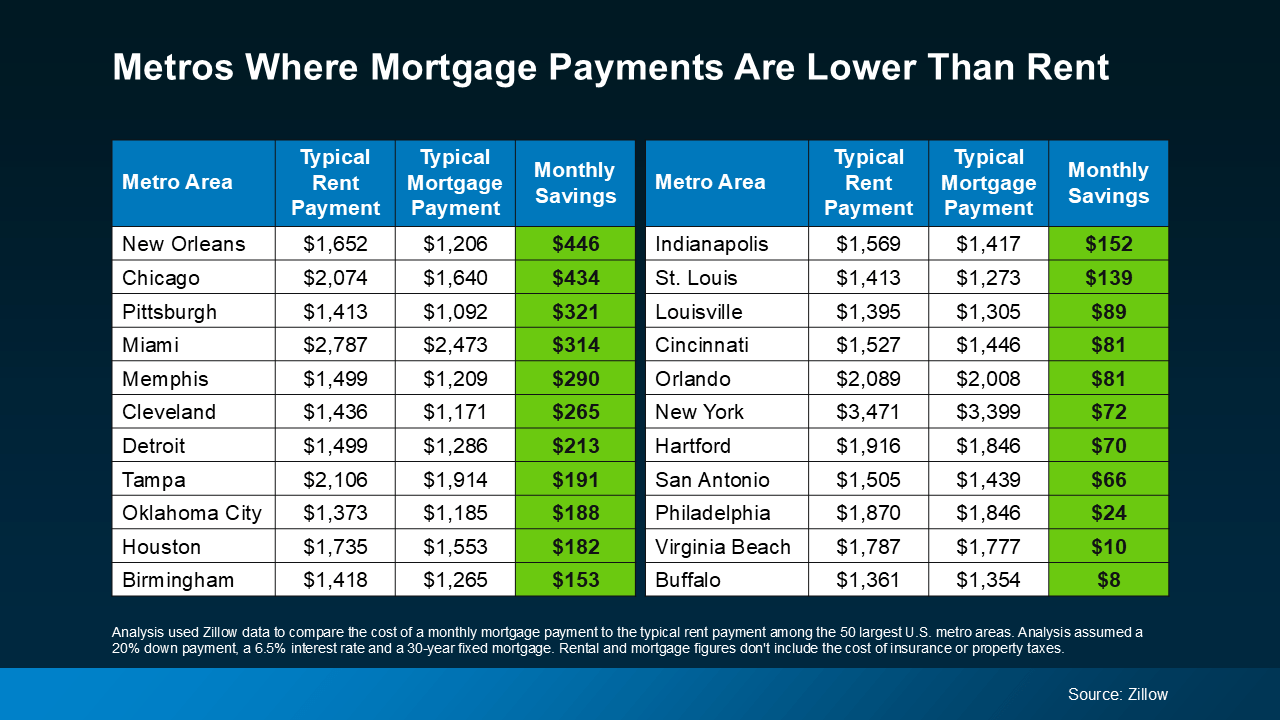

That’s correct—according to a recent study from Zillow, in 22 of the 50 largest metro areas, monthly mortgage payments are now lower than rent payments (see chart below):

As mortgage rates have decreased from their recent peak, home prices have stabilized, and inventory has increased, affordability has improved significantly. When you consider all these factors, buying a home is becoming less expensive than renting in many areas of the country.

This is particularly important if you’ve been renting for a while. However, if your city isn’t on this list, don’t worry. Changes are happening quickly, and your area could soon join these top metros.

Consulting with a local real estate agent about the current market in your area before these changes take place could greatly benefit you. Being informed by a true expert can help you understand that what once seemed out of reach may now be more affordable than you think.

While this study compares monthly rent to the principal and interest on a mortgage payment (excluding the entire monthly payment), it's essential to consider additional costs when buying a home, such as taxes, insurance, utilities, and maintenance that should be included in your budget.

However, renters also face extra fees, such as renters’ insurance, utilities, parking, and more. Although crunching the numbers may seem tedious, this calculation could be much more promising today.

So, grab your calculator and your agent because the key takeaway is this: it may be time to see if you can afford what you couldn't just a few months ago.

As Orphe Divounguy, Senior Economist at Zillow, states:

“… for those who can make it work, homeownership may come with lower monthly costs and the ability to build long-term wealth in the form of home equity — something you lose out on as a renter. With mortgage rates dropping, it's a great time to see how your affordability has changed and if it makes more sense to buy than rent.”

Whether you reside in one of these budget-friendly metros where the balance has already shifted in your favor, or in any town in between, it's time to reach out to a local real estate agent to start the conversation.

With mortgage rates declining and more homes becoming available, you'll want to be prepared to dive back into your search—before everyone else does.

Bottom Line

If you're tired of renting and want to explore what it takes to purchase a home in our area as the landscape shifts, let’s calculate together to determine if buying a home makes sense for you now or in the near future.

Categories

Recent Posts