The Five-Year Rule for Home Price Perspective

The Five-Year Rule for Home Price Perspective

Some headlines claim that home prices are beginning to decline in certain areas. And if that has you questioning your next move, here’s the key takeaway:

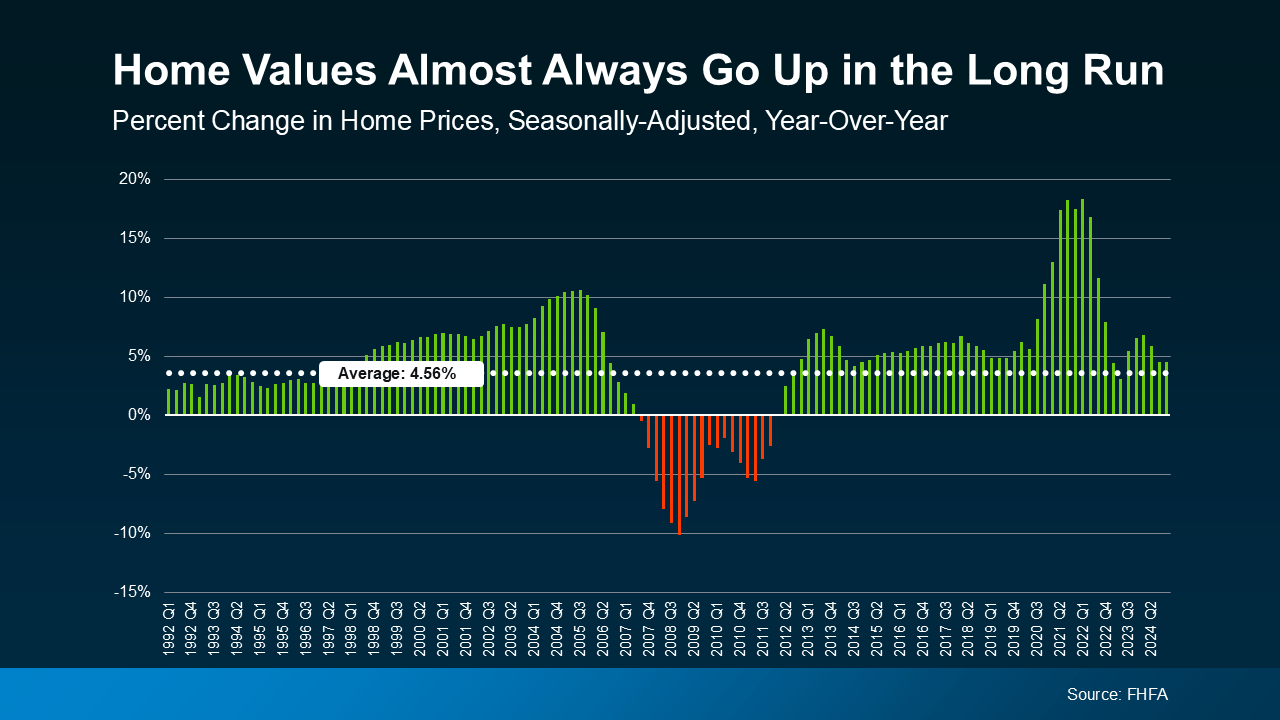

While a few markets are experiencing modest price drops, don’t lose sight of this important fact — home values tend to increase over time (see graph below):

While the 2008 housing crash is still fresh in many minds, it was an outlier – not a typical market event. That period was marked by drastically different conditions like overly lenient lending, minimal homeowner equity, and an oversupply of homes. Today’s housing landscape doesn’t reflect those same vulnerabilities. So, when you hear news about prices leveling out or dipping slightly, it doesn’t mean a crash is looming.

Here’s a helpful perspective on why short-term price fluctuations shouldn’t be alarming.

What’s the Five-Year Rule?

In real estate, the five-year rule suggests that if you plan to own your home for at least five years, temporary price dips usually aren’t a major issue. Over time, home values tend to rise, meaning even a short-term drop can rebound and grow beyond its original value.

As Lance Lambert, Co-Founder of ResiClub, puts it:

“. . . there’s the ‘five-year rule of thumb’ in real estate—which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

What’s Going On in Today’s Market?

Currently, most housing markets are still seeing home prices appreciate — just at a slower pace than in recent years.

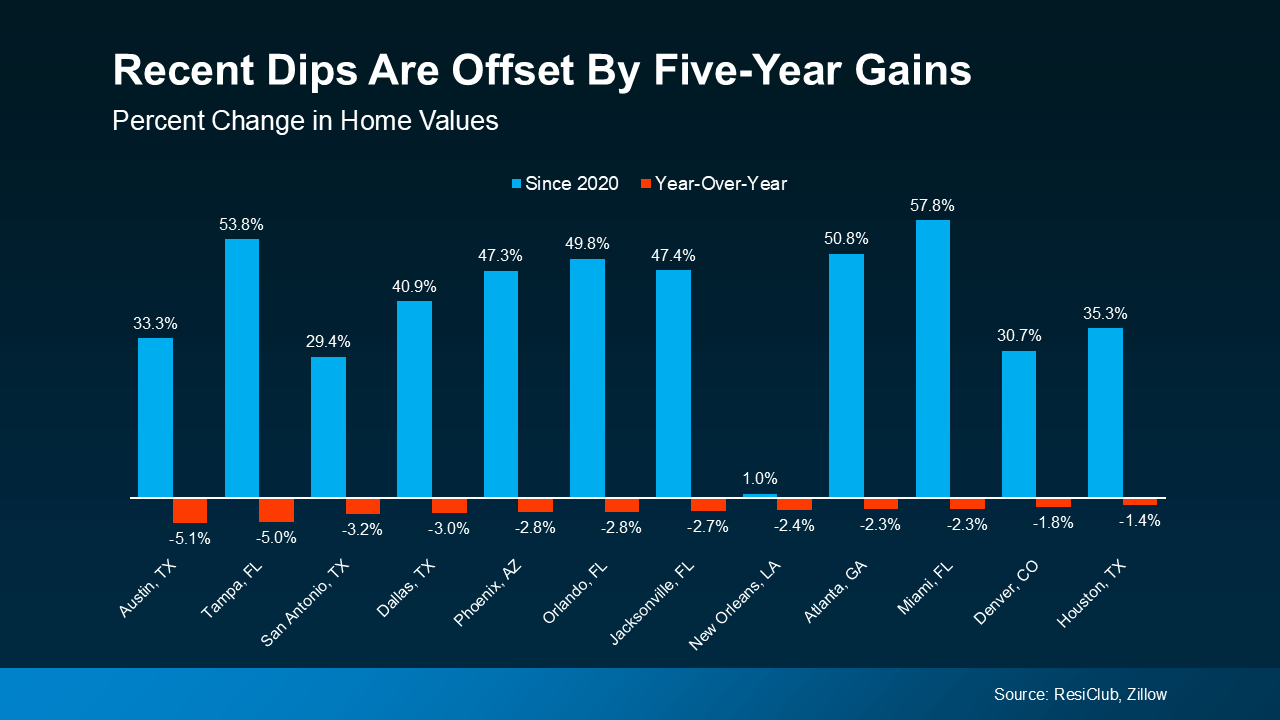

Even in the major metros showing some cooling (indicated by the red bars in the graph below), the average decline is only around -2.9% since April 2024. That’s a far cry from the substantial drops of 2008.

And if you take a broader look at those markets over the past five years (represented by the blue bars), home prices have still risen significantly. That means homeowners who’ve been in their properties for several years are still in a strong position (see graph below):

The Big Picture

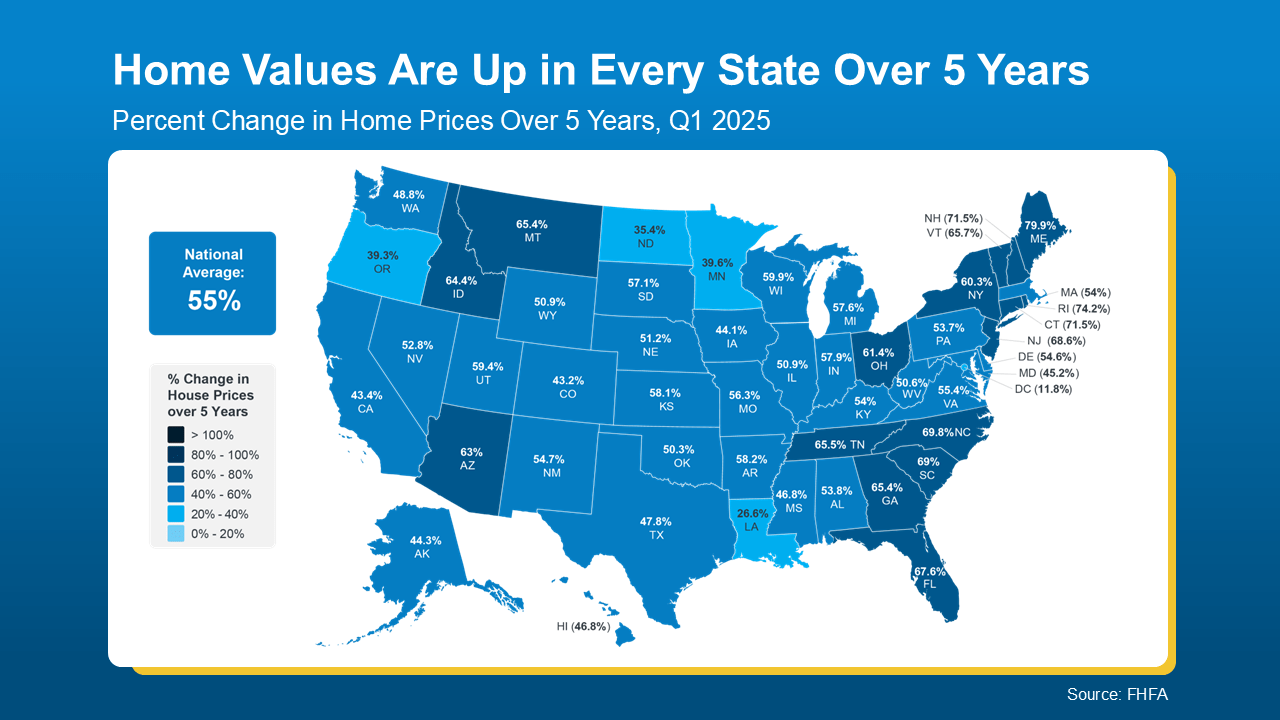

In the last 5 years, home prices have surged by 55%, based on data from the Federal Housing Finance Agency (FHFA). That means a small, short-term price dip isn’t a major concern. Even if your local market has seen a slight 2% decrease, you're still well ahead overall.

Breaking it down further with FHFA data shows every state has experienced price growth over the past five years (see map below):

That’s why it’s key not to get too caught up in what’s happening this month or even this year. If you’re planning to stay in your home long-term (like most homeowners), chances are its value will increase over time.

Bottom Line

Home prices can shift in the short run. But historically, home values tend to rise — especially if you stay in your home for five years or more. So if you’re considering buying or selling, remember the five-year rule and focus on the bigger picture.

Think about where you want to be five years from now — does homeownership fit into that vision?

Let’s talk about how to make that happen.

Categories

Recent Posts