Buying Your First Home? FHA Loans Can Help

Buying Your First Home? FHA Loans Can Help

If you're a first-time homebuyer, it may feel like the odds are against you in today’s market. But the good news is there are tools and programs available to help — if you know where to look. One key option that could make buying a home more attainable? An FHA home loan.

These loans are built to help buyers clear some of the biggest financial roadblocks — and that’s why so many first-time buyers rely on them.

Whether you’re hoping to stop renting, settle down, or simply have a place to call your own, an FHA loan might help make that happen sooner than you expect.

Buying Your First Home May Feel Challenging Right Now

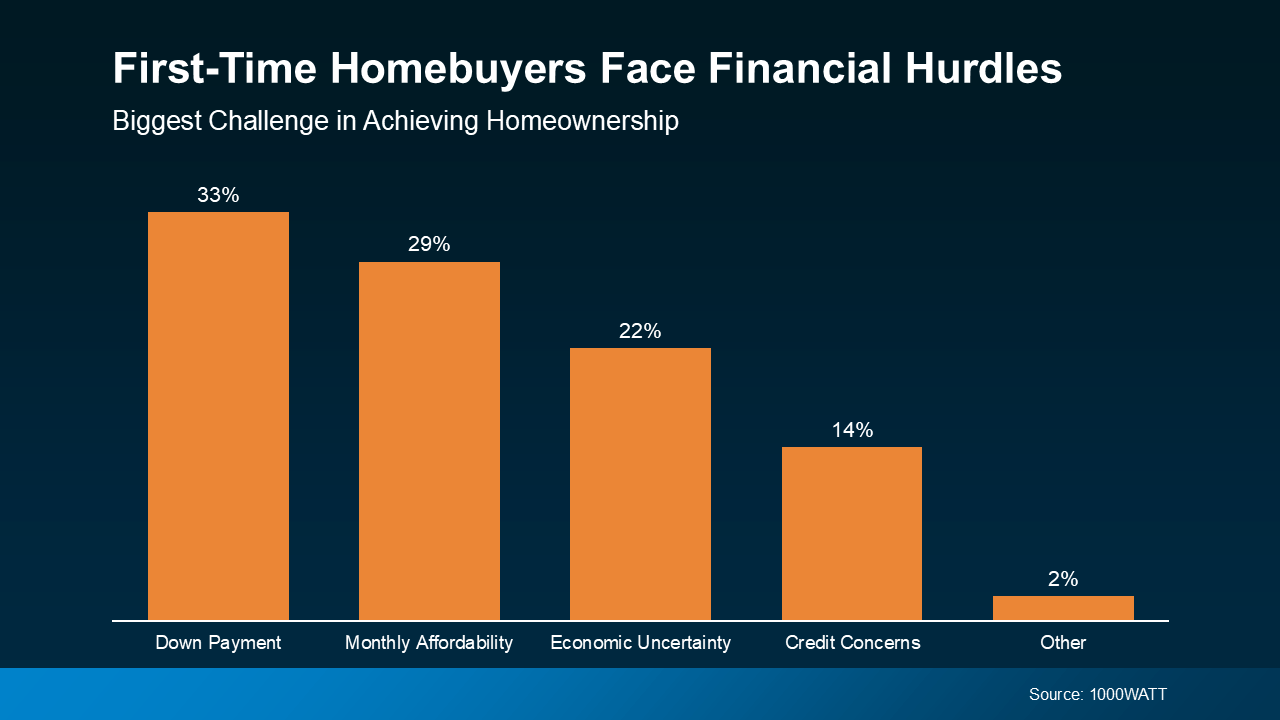

While many people still want to become homeowners, affordability is a big concern. A recent survey from 1000WATT found the top two worries for first-time buyers are saving enough for a down payment and being able to handle monthly mortgage payments at current home prices and rates (see graph below):

That’s Where FHA Loans Come In

FHA loans offer a solution for many first-time buyers facing affordability challenges.

According to Intercontinental Exchange (ICE), the average down payment for first-time buyers using an FHA loan is just $16,000. That’s significantly lower than the $77,000 average down payment typically required for a conventional mortgage (see graph below):

Essentially, using an FHA loan could mean needing less money up front — and potentially having a lower monthly payment, too.

That’s because FHA loans often come with a more favorable mortgage rate. Bankrate explains:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

If you’re planning to buy your first home, an FHA loan could be worth considering.

With its lower down payment requirements and possible rate advantage, it may help ease the biggest concerns first-time buyers face — coming up with enough savings and managing monthly costs.

A knowledgeable lender can help break it all down, compare loan types, and guide you toward the best fit for your financial picture.

Bottom Line

The right loan and expert advice can bring homeownership within reach sooner than you think.

Want to explore your options? A trusted lender can help.

Categories

Recent Posts