Is It Better To Rent or Buy a Home?

Is It Better To Rent or Buy a Home?

You may have wondered recently: Is now really a good time to buy a home?

With home prices remaining high and mortgage rates still elevated, renting might appear to be the safer or even only option. That feeling is completely valid. And for some, waiting might actually be the better choice. Purchasing a home should only happen when you’re both financially and personally ready.

But here’s something important to consider about renting.

Although renting may feel like a more stable option right now — and in certain areas, could even be more affordable in the short term — it may end up costing you more as time goes on.

A Bank of America survey recently revealed that 70% of those hoping to buy are concerned about what renting long-term could mean for them financially. And those concerns are completely understandable.

Owning a home might seem unattainable at the moment, but creating a plan and working toward that goal can lead to major financial advantages down the line.

Homeownership Builds Wealth Over Time

Purchasing a house is more than just securing a place to live — it’s an investment in your financial future.

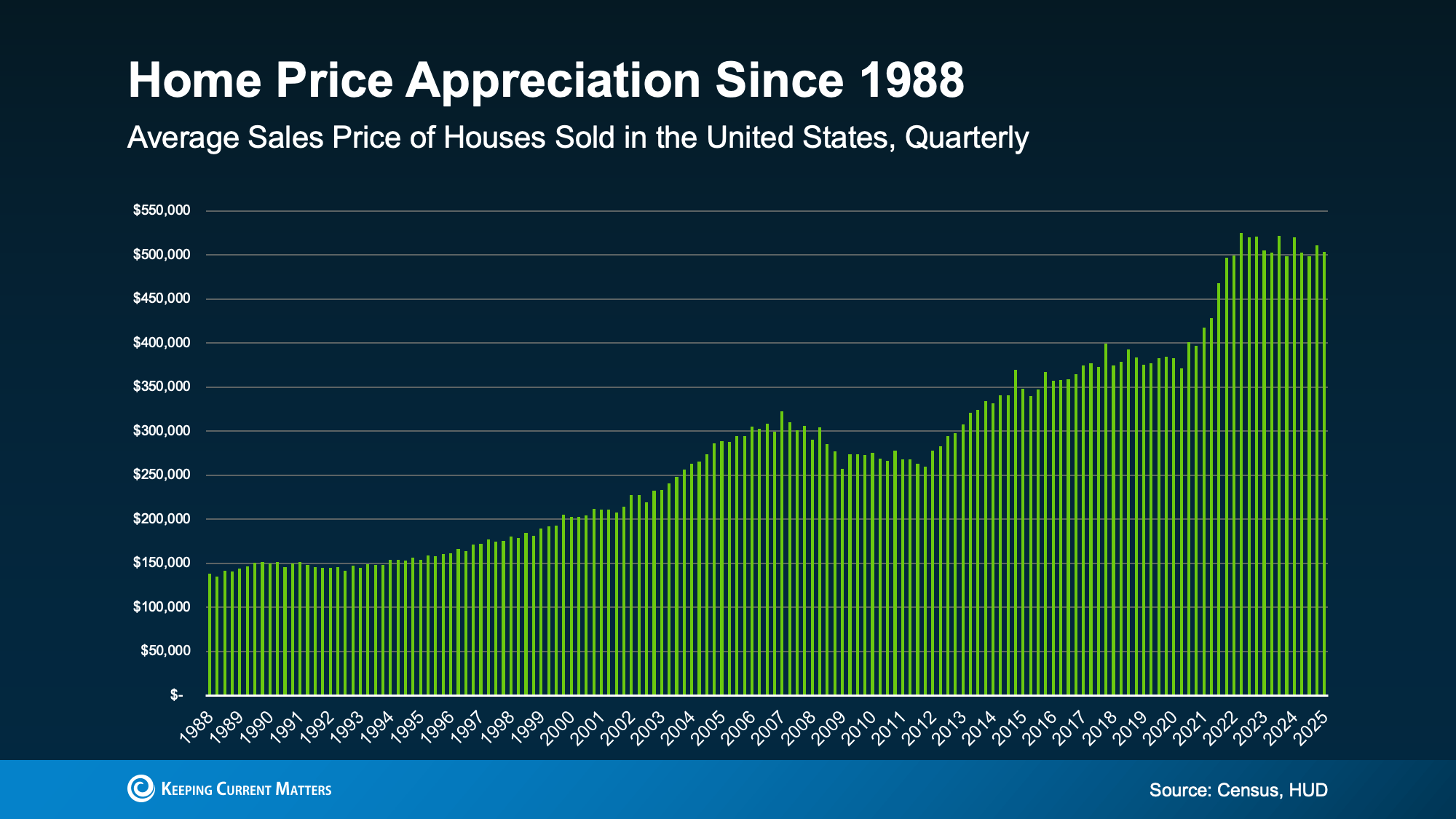

Why is that? Because historically, home prices tend to increase, so delaying your purchase could mean buying at a higher cost later. And although some areas are seeing slight price adjustments, the long-term trend clearly shows ongoing growth (see graph below):

As home prices increase, so does the equity you build as a homeowner. Equity is the difference between your home’s value and the remaining balance on your mortgage. Each time you make a payment, that equity grows. Eventually, it becomes a significant part of your overall financial worth.

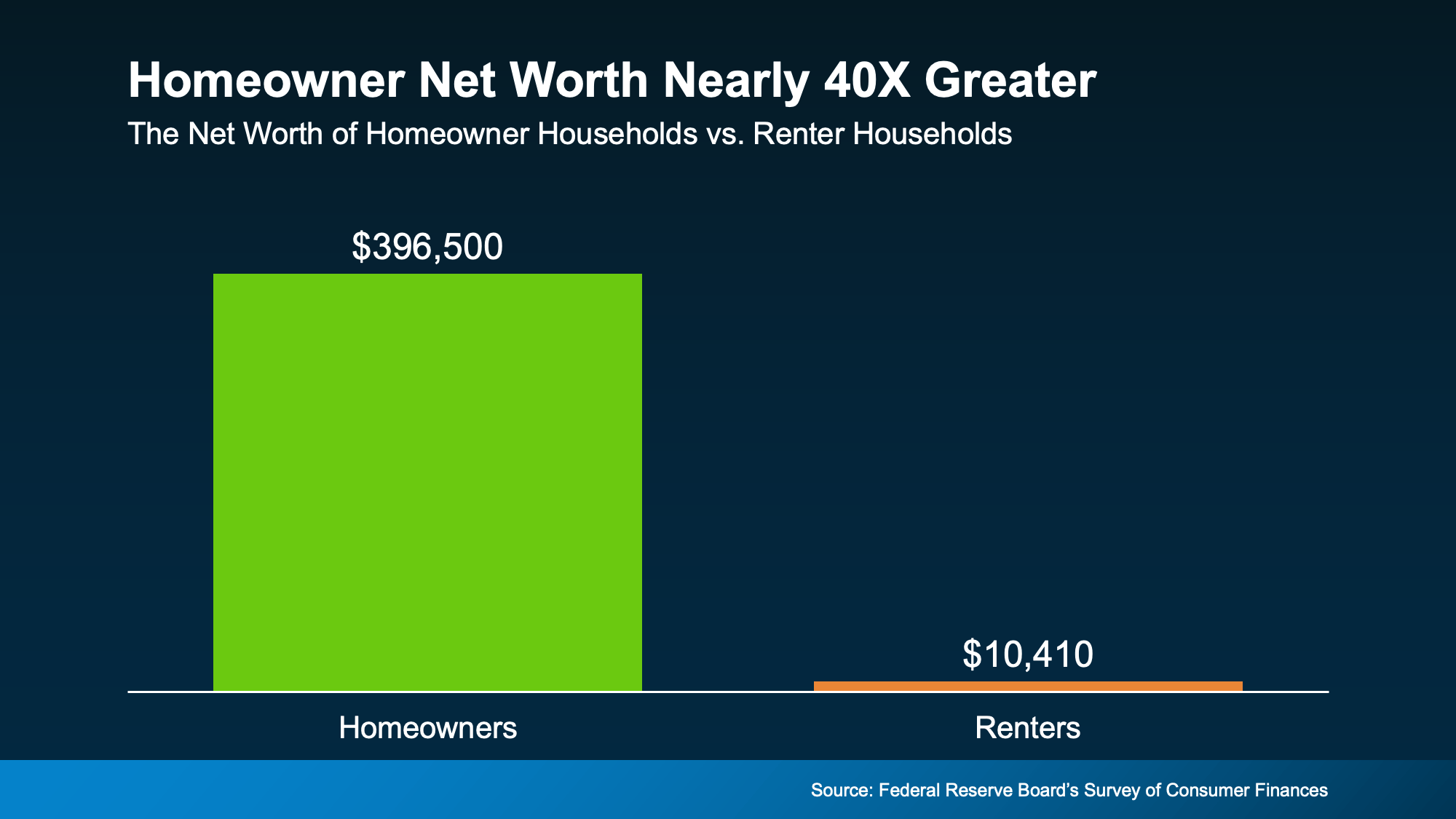

At present, the typical homeowner has a net worth that’s nearly 40 times higher than the average renter. That’s a striking contrast – and the data in the visual below clearly shows it (see graph below):

That’s a major reason why Forbes notes:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

The Biggest Downside of Renting

In the short term, renting may appear easier – monthly costs are often lower, there’s less upkeep, and you’re not tied down. But over time, it can become a financial burden.

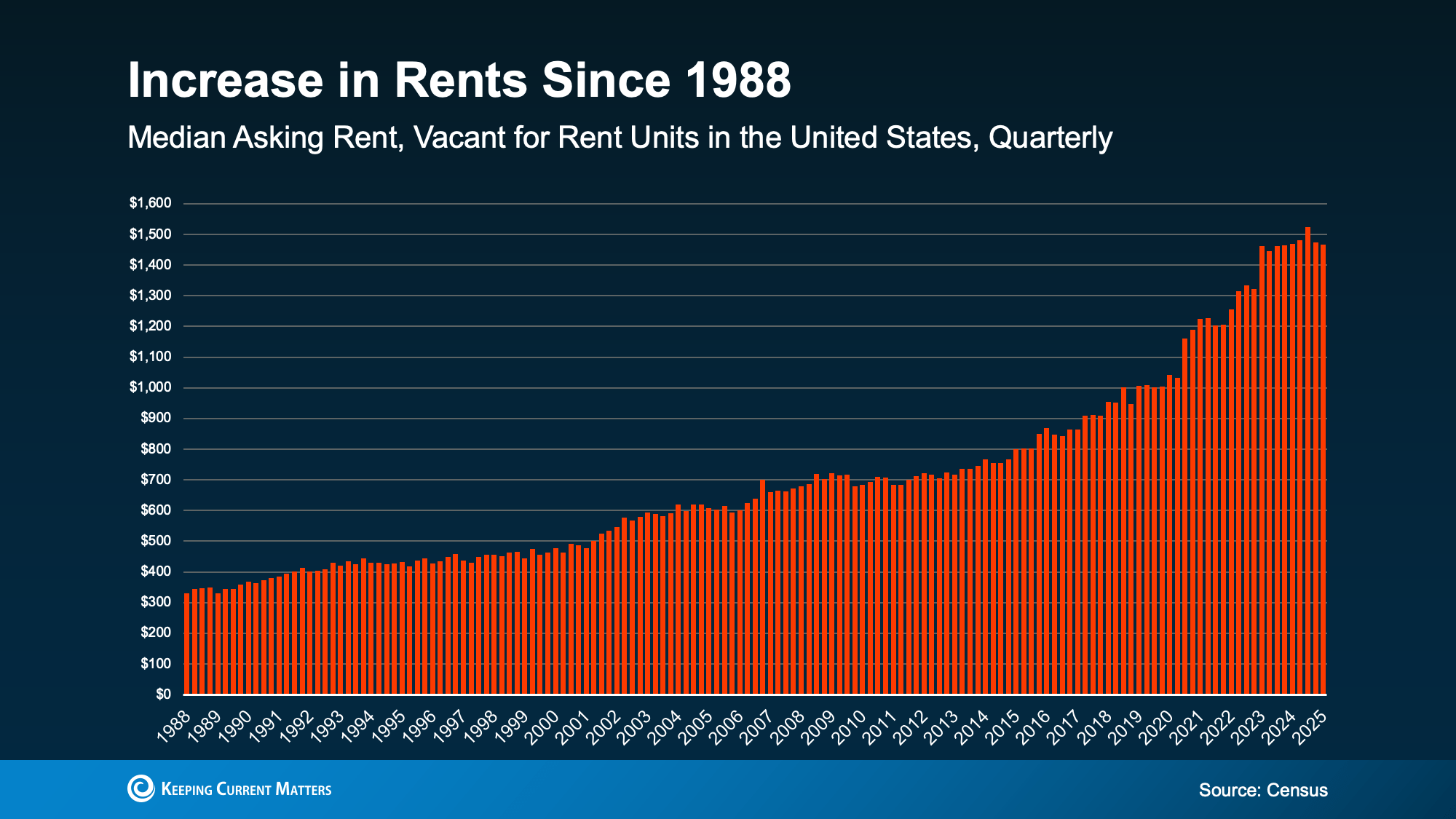

Home prices have consistently climbed over the years – and rent has followed a similar path. Even though rental prices have leveled off in some areas recently, the historical trend shows a steady increase. That upward movement only makes it tougher to save for a future home (see graph below):

That kind of financial uncertainty takes a toll. According to the same Bank of America survey, 72% of future buyers are concerned that increasing rent could negatively affect both their present and future finances.

Rent doesn’t help you build wealth. It doesn’t provide a return. It simply covers your landlord’s mortgage – not your own.

So whether you're renting or owning, you're paying a mortgage either way. The real question is: whose mortgage are you paying?

Renting vs. Buying: What Really Matters

Here’s another way to look at it. When you rent, your money is gone after each payment. But when you own, your payments build equity – it’s like putting money into a savings account you live in. Yes, owning comes with added responsibilities, but it also brings long-term benefits. And that’s why having a strategy to reach homeownership is essential.

As Joel Berner, Senior Economist at Realtor.com, says:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Bottom Line

While renting might feel like the simpler option today, it could end up costing you more in the long term – without giving you a path toward financial growth.

If homeownership seems far off, you're not the only one feeling that way. The key to moving forward is creating a plan. Let’s connect, outline your goals, and review your options – so you’re ready when the time is right.

Categories

Recent Posts