Stocks May Be Volatile, but Home Values Aren’t

Stocks May Be Volatile, but Home Values Aren’t

With the economy in a state of uncertainty, the stock market has been fluctuating more than usual. If you’ve been tracking your 401(k) or investments recently, it’s likely you’ve experienced that unsettling feeling. One day, it’s up; the next, it’s down. That could leave you feeling a bit anxious about your finances.

However, here’s something to keep in mind if you own a home. As Investopedia notes:

“Traditionally, stocks have been far more volatile than real estate. That's not to say that real estate prices aren't ever volatile—the years around the 2007 to 2008 financial crisis are just one memorable example—but stocks are more prone to large value swings.”

While your 401(k) or stocks might see frequent fluctuations, home values are generally much more stable.

A Decline in the Stock Market Doesn’t Necessarily Mean a Decline in Home Prices

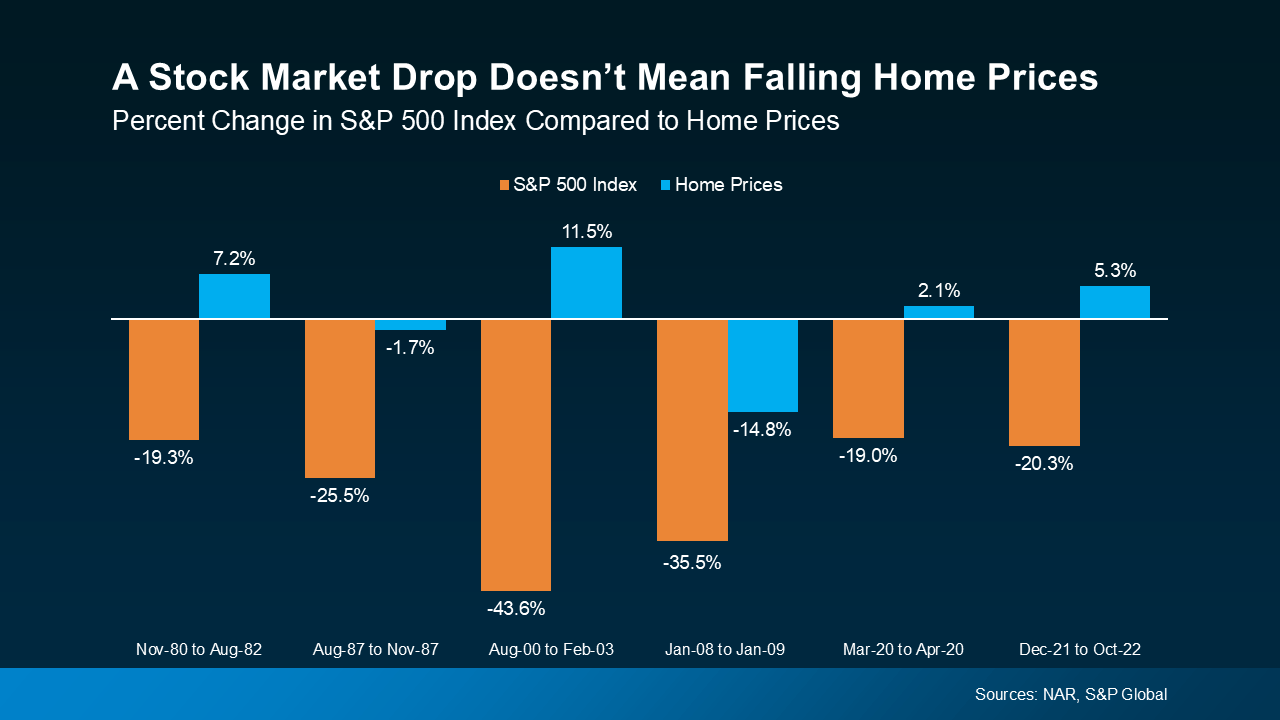

Look at the graph below. It demonstrates what happened to home prices (shown in blue) during previous stock market fluctuations (represented by the orange bars):

Even when the stock market experiences a significant decline, home prices don’t always follow suit.

Large drops in home values, like in 2008, are rare exceptions, not the norm. However, that particular crash is unforgettable. It was driven by lax lending practices, subprime mortgages, and an oversupply of homes—a situation that’s not present today. That’s what made it such a unique event.

In many instances before and after that period, home values actually increased while the stock market declined, highlighting the stability of real estate.

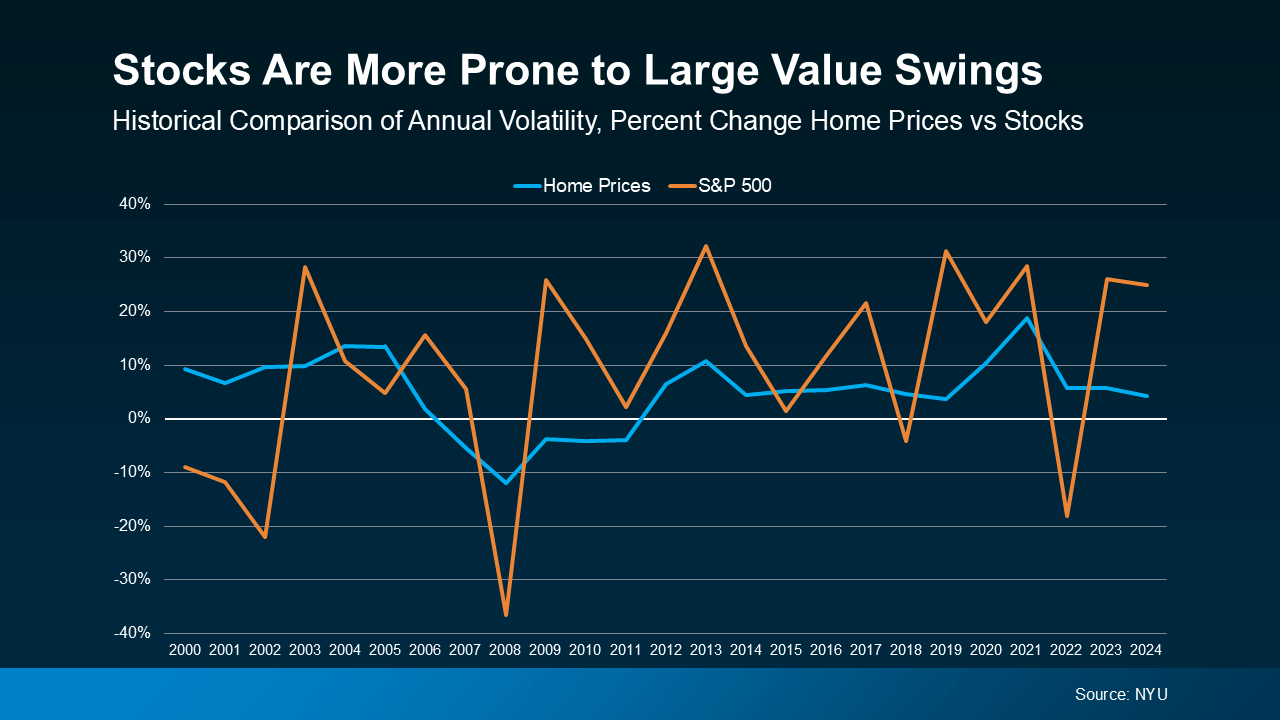

The graph below illustrates how stock prices (the orange line) fluctuate, sometimes by more than 30% in a single year. In contrast, home prices (represented by the blue line) change more gradually:

In essence, stock values fluctuate far more than home prices. You might see a big rise one day and a sharp drop the next. Real estate, however, doesn’t typically experience such drastic swings.

This is why real estate is often seen as more stable and less risky than the stock market.

So, if the recent ups and downs in your stock portfolio have you feeling uneasy, take comfort in knowing your home is unlikely to see the same level of volatility.

That’s why homeownership is often considered a preferred long-term investment. Even if things seem uncertain now, homeowners generally come out ahead over time.

Bottom Line

Many are feeling anxious about their finances these days. But one thing that can provide reassurance is your investment in something that has stood the test of time: real estate.

Categories

Recent Posts