The 20% Down Payment Myth, Debunked

The 20% Down Payment Myth, Debunked

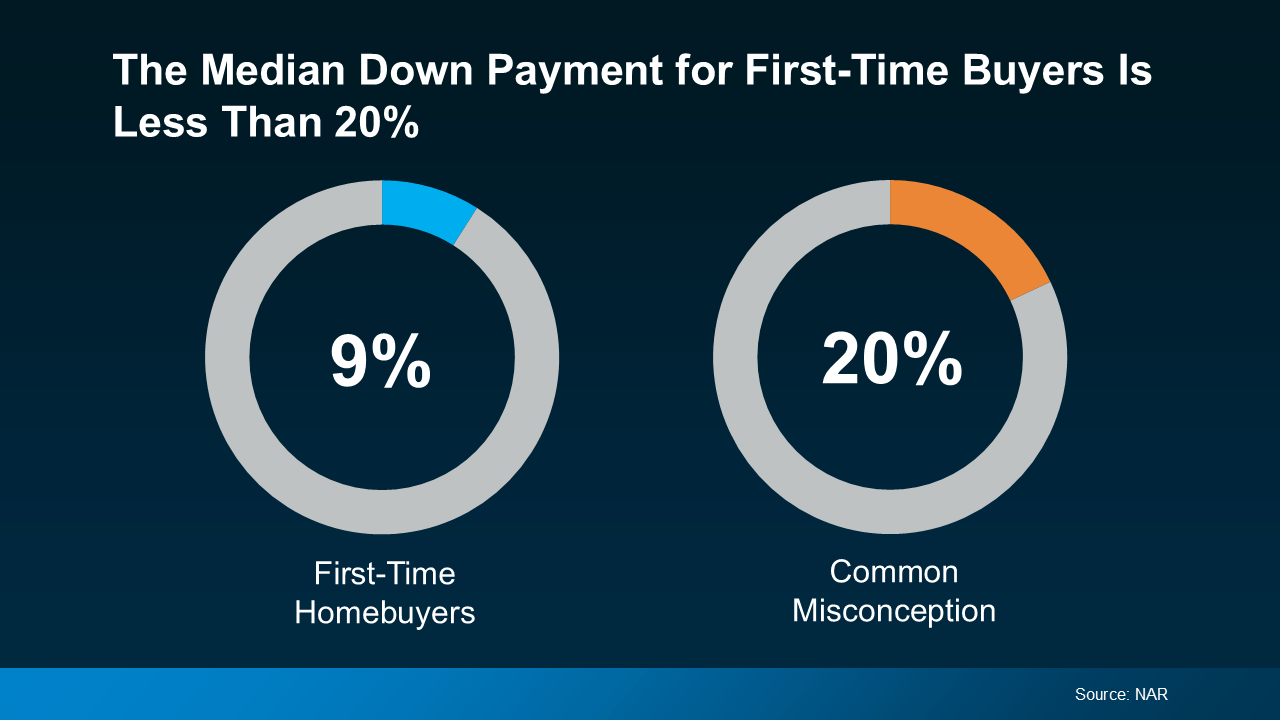

Buying a home can feel overwhelming, especially when you’re saving up for it. For many first-time buyers, the idea that a 20% down payment is required can seem like a major hurdle.

But here’s the reality – that belief is actually a common myth.

Is a 20% Down Payment Really Necessary?

Unless your loan type or lender specifically requires it, chances are you won’t need to put down 20%. In fact, there are several loan options designed to help first-time buyers get started with a much lower down payment.

FHA loans, for instance, allow down payments as low as 3.5%. VA and USDA loans even offer zero down payment options for qualified applicants, such as Veterans. While a higher down payment does have its advantages, it’s not a must. As The Mortgage Reports states:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

Data from the National Association of Realtors (NAR) also shows that first-time buyers typically put down much less—just 9% on average.

What’s the key takeaway here? You might not need to save as much as you once thought.

Even better, there are plenty of programs out there specifically created to help boost your down payment savings — and chances are, you might not even know they exist.

Why Explore Down Payment Assistance Programs?

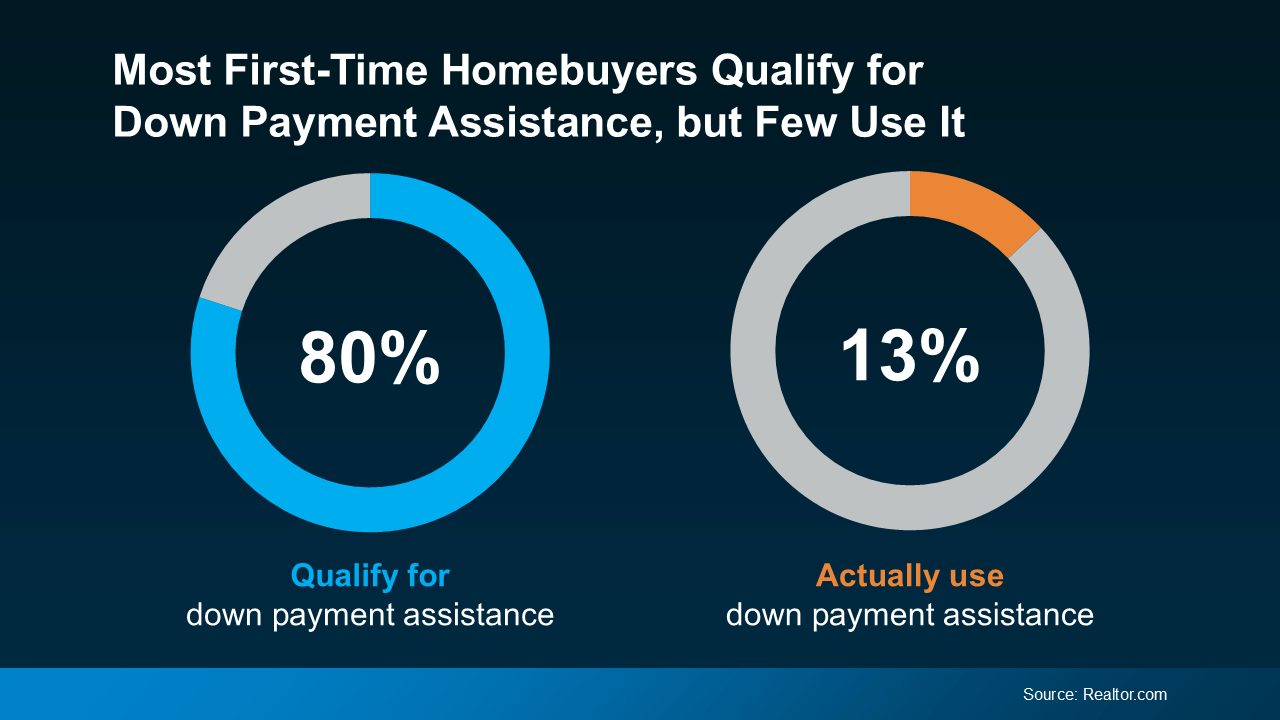

Surprisingly, nearly 80% of first-time buyers are eligible for down payment assistance (DPA). But here’s the catch — only 13% take advantage of it.

That’s a major missed opportunity. These assistance programs can offer substantial support — often totaling thousands of dollars — to help with your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, explains:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Just think how much further your savings could go with an extra $17,000. In some cases, you may even be able to combine multiple programs to stretch your budget even more. These are the kinds of advantages you don’t want to overlook.

Bottom Line

Saving for your first home might feel overwhelming — especially if you’re still holding onto the 20% down payment myth. The truth is, many loans require far less, and down payment assistance programs can give your savings a big boost.

Want to know what options you may qualify for? Start by speaking with a trusted lender.

Categories

Recent Posts