The Benefits of Using Your Equity To Make a Bigger Down Payment

The Benefits of Using Your Equity To Make a Bigger Down Payment

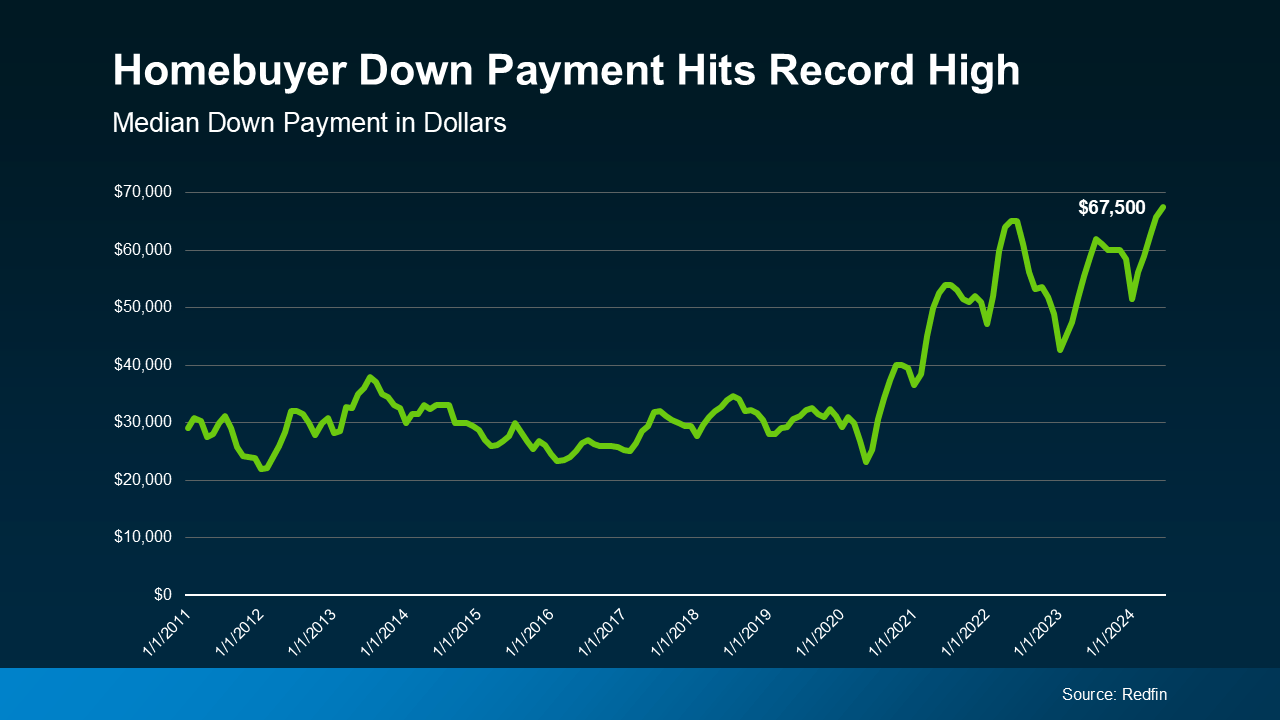

Did you know? Homeowners often have the opportunity to put more money down when purchasing their next home. After selling their current house, they can apply the equity they’ve built toward their next down payment. This is why, as home equity reaches new heights, the median down payment has also increased.

According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500—nearly 15% more than last year and the highest amount on record (see graph below):

Here’s why equity makes this possible: Over the past five years, home prices have risen significantly, resulting in a substantial increase in equity for current homeowners like you. When you sell your house and move, you can apply that equity toward a larger down payment on your new home. This presents a major opportunity, especially if you've had concerns about affordability.

It's important to remember that you don’t have to make a large down payment to purchase your next home—there are loan programs available that allow you to put down as little as 3% or even 0%. However, many current homeowners are choosing to put more money down because it comes with some significant benefits.

Why a Bigger Down Payment Can Be a Game Changer

1. You’ll Borrow Less and Save More in the Long Run

When you use your equity to make a larger down payment on your next home, you won’t need to borrow as much. The less you borrow, the less interest you’ll pay over the life of your loan. That translates to significant savings in your pocket for years to come.

2. You Could Get a Lower Mortgage Rate

Making a larger down payment demonstrates to your lender that you’re financially stable and not a high credit risk. The more confident your lender is in your credit score and your ability to repay the loan, the lower the mortgage rate they are likely to offer you. This, in turn, increases your savings.

3. Your Monthly Payments Could Be Lower

A larger down payment not only reduces the amount you need to borrow but also means your monthly mortgage payment may be smaller. This can make your next home more affordable and provide you with some extra breathing room in your budget.

4. You Can Skip Private Mortgage Insurance (PMI)

If you can put down 20% or more, you can avoid Private Mortgage Insurance (PMI), which is an additional cost that many buyers must pay if their down payment is smaller. Freddie Mac explains it this way:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner's insurance. It's a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

Avoiding PMI means you’ll have one less monthly expense to worry about, which is a significant benefit.

Bottom Line

Down payments are currently at a record high, primarily due to recent equity gains that allow homeowners to put more money down.

If you’re considering selling your current house and moving, let’s collaborate to determine how much home equity you have right now and how it can enhance your buying power in today’s market.

Categories

Recent Posts