The Truth About Newly Built Homes and Today’s Market

The Truth About Newly Built Homes and Today’s Market

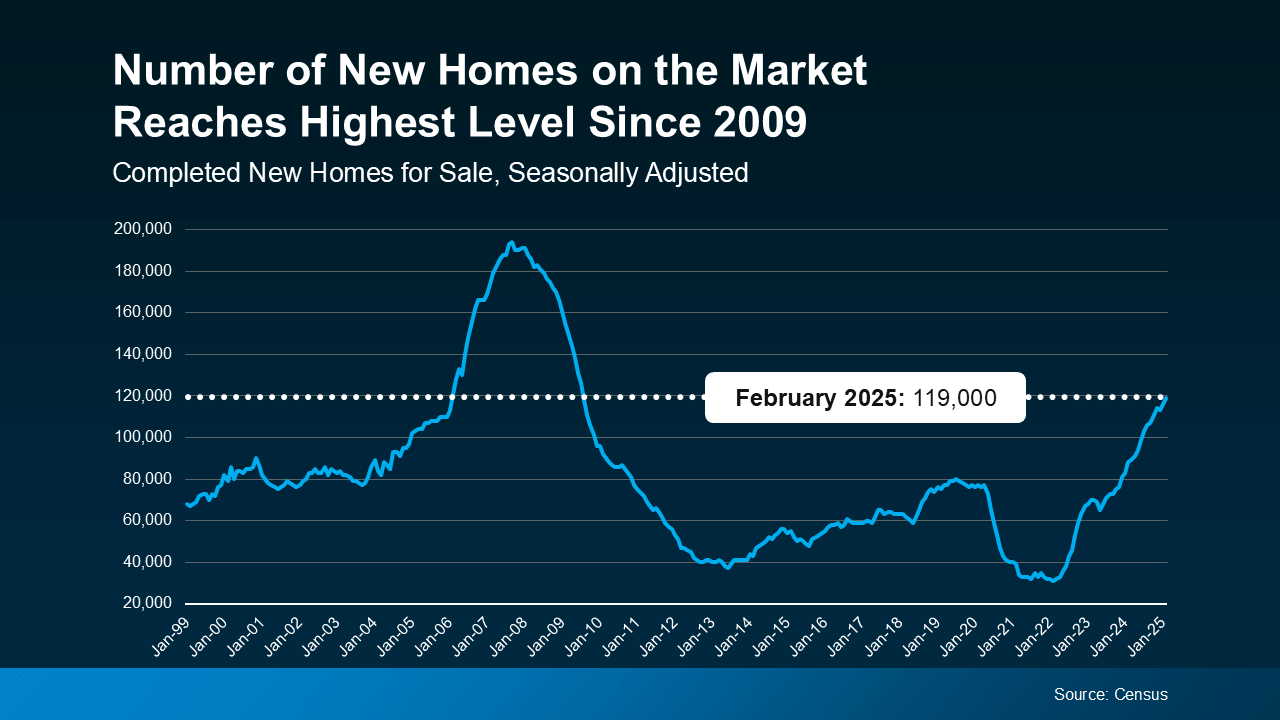

Recent headlines about the inventory of new homes reaching levels last seen in 2009 might evoke concerns reminiscent of the late 2000s housing crash. If you're feeling uneasy, it's essential to look beyond the sensationalism of these headlines, which often aim more to attract clicks than provide clarity.

Why This Isn’t Like 2008

It's crucial to understand that while it's true the inventory of new homes is at its highest since 2009, this isn't necessarily a sign of impending trouble.

Here’s the important context: When you look at the data visually through a graph, you can see that the high inventory levels of 2009 were not the peak of an oversupply. In fact, the actual peak occurred earlier, around 2007-2008. By 2009, the number of new homes being built had already begun to decline, signaling a recovery phase rather than a crisis (see graph below):

This perspective helps to illustrate that the current levels of home inventory, while high compared to recent years, are not indicative of the same conditions that led to the housing crash. Instead, they might be seen as part of a natural market correction or response to pent-up demand.

The overbuilding that played a significant role in the housing crash occurred in the years leading up to 2008, not in 2009. By that year, construction rates had already begun to decrease. Therefore, reaching inventory levels similar to those of 2009 does not suggest we are overbuilding as we did before the crisis.

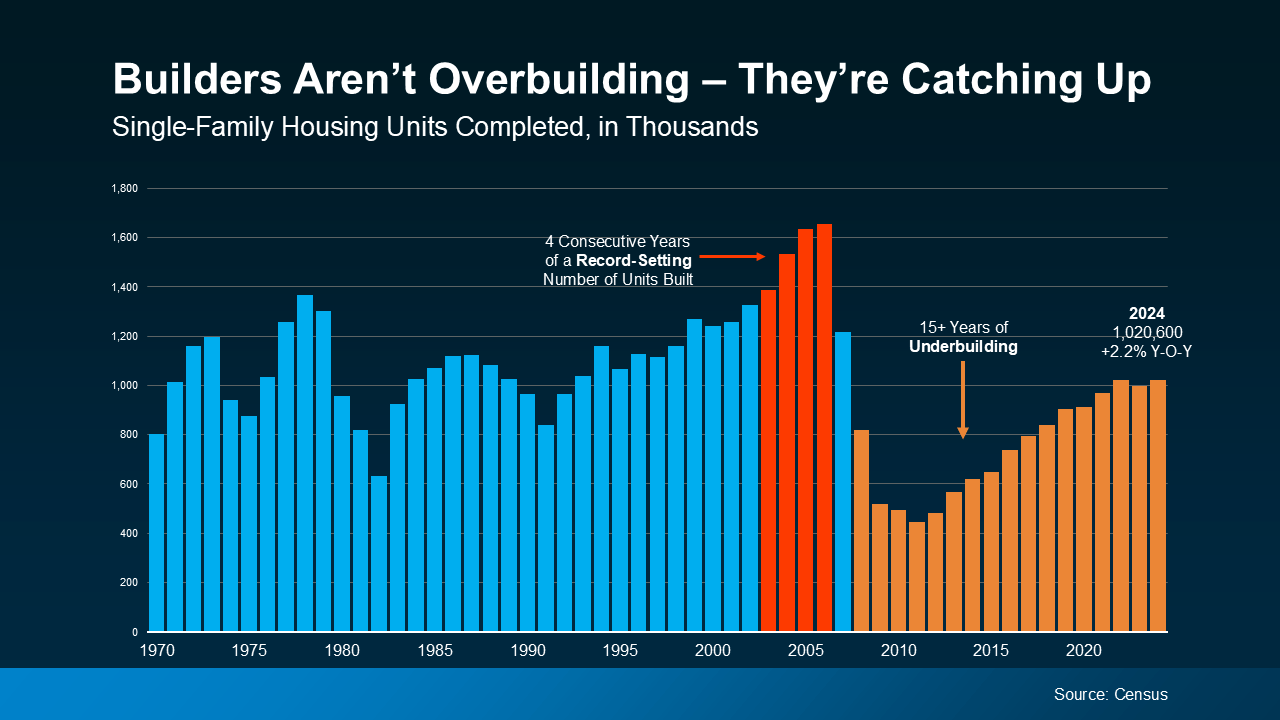

Builders Have Been Underbuilding for Over a Decade

Post-crash, there was a significant pullback in construction. Builders dramatically scaled down their operations, leading to the production of far fewer homes than were needed by the market. This underbuilding persisted for over a decade, creating a pronounced housing shortage that remains an issue today.

The accompanying graph, which utilizes Census data from the past 52 years, vividly displays these trends. You can see the excessive construction marked in red leading up to the crash, followed by a prolonged period of underbuilding shown in orange. Only recently have construction levels begun to normalize, indicating that current building rates are more about catching up to demand rather than exceeding it.

Today's housing market scenario is distinctly different from the past. Builders are not overbuilding; they are merely catching up to the existing demand.

In a recent discussion, Odeta Kushi, Deputy Chief Economist at First American, emphasized the deficit in home construction and explained why the current increase in construction activity is beneficial for the market, particularly for buyers.

“This means more homes on the market and more options for home buyers, which is good news for a housing market that has been underbuilt for over a decade.”

Indeed, in real estate, the dynamics of supply and demand can differ significantly from one market to another. Some areas might see an influx of newly built homes, while others may experience less. However, on a national scale, the current increase in new home construction is not a cause for alarm. This situation is distinct from previous market conditions.

Bottom Line

Regardless of the headlines or market trends you might come across, the growing inventory of newly built homes across the country shouldn't be viewed as a red flag. Instead, it represents a positive shift where builders are addressing the backlog caused by years of underbuilding. If you're curious about how these dynamics are playing out in our local market, let's get in touch and discuss the specifics.

Categories

Recent Posts