Thinking about an Adjustable-Rate Mortgage? Read This First.

Thinking about an Adjustable-Rate Mortgage? Read This First.

If you've been in the market for a home recently, you're likely aware of how current mortgage rates can impact affordability. Combined with increasing home prices, these rates are prompting many buyers to look into different loan options. One that's becoming more common? Adjustable-rate mortgages (ARMs).

If the 2008 housing crash comes to mind, it's understandable to feel uneasy. But today’s ARMs are different. Here’s what’s changed.

In the past, some borrowers were approved for loans they couldn’t afford once their rates adjusted. Now, lending standards are stricter, and lenders assess whether buyers can still manage the loan if rates rise. So, the recent uptick in ARMs doesn’t point to another crash—it just highlights that buyers are exploring flexible solutions in a challenging market.

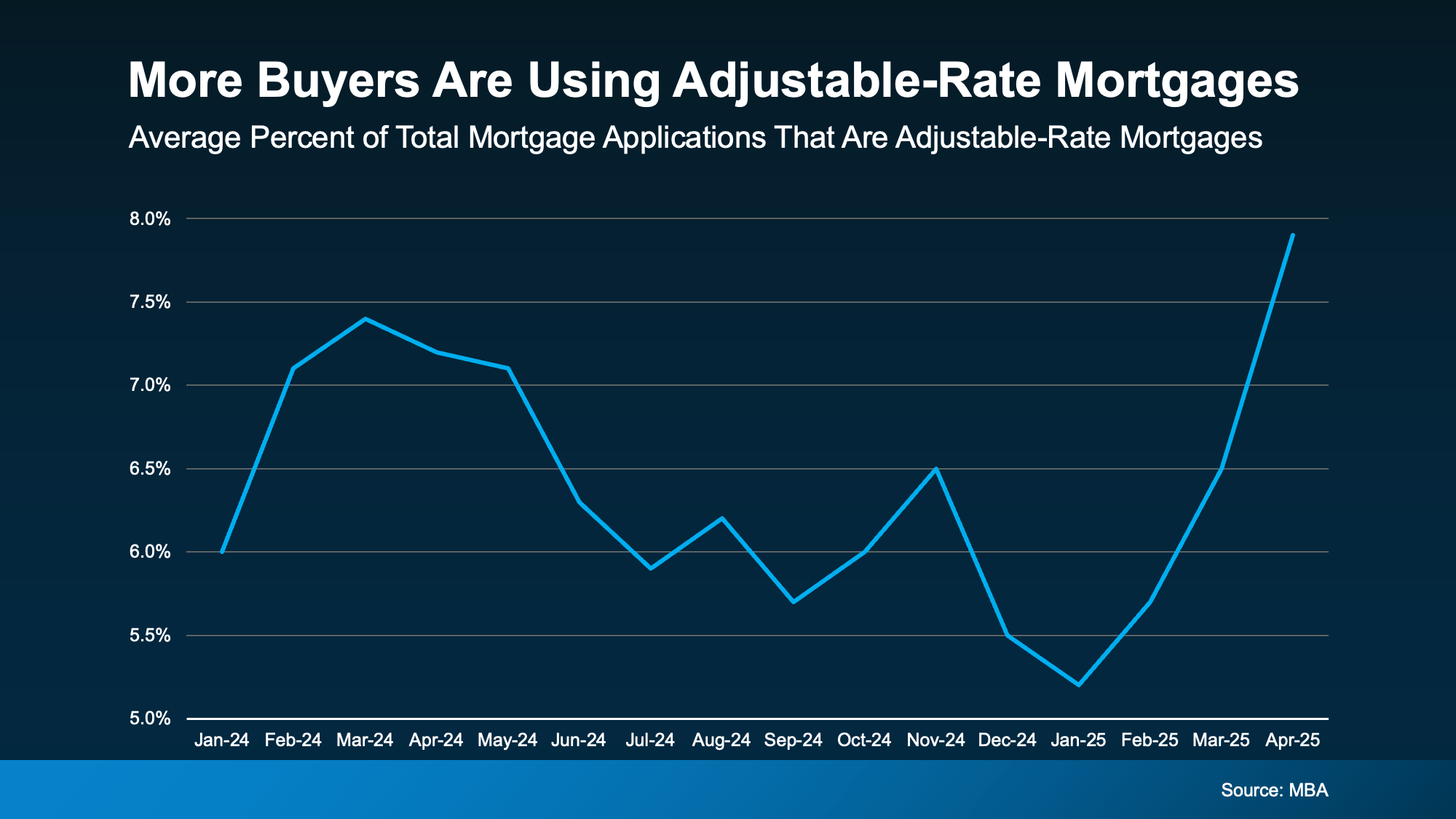

And that trend is reflected in the latest data from the Mortgage Bankers Association (MBA), showing more buyers turning to ARMs right now (see graph below):

Even though ARMs aren’t suitable for everyone, they can offer valuable benefits in the right scenario.

How an Adjustable-Rate Mortgage Works

Business Insider breaks down the key difference between fixed-rate and adjustable-rate mortgages:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You'll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they've gone down, your payment will decrease.”

While fixed-rate mortgages are more stable, outside costs like taxes or insurance can still cause some changes. But the core of your monthly payment remains consistent. That’s not the case with ARMs.

Pros and Cons of an ARM

Here’s why some buyers are considering ARMs again. One major advantage is the lower initial interest rate. Business Insider notes:

"Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan."

Still, keep in mind that the rate on an ARM doesn’t stay the same. Barron’s explains the risk this way:

"Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up."

So even though the savings at the beginning may help now, it’s important to consider what your payment could look like when the rate adjusts. Even though experts expect some relief in interest rates over the next year or two, predictions aren’t guaranteed.

That’s why it’s so important to discuss your options with your lender and financial advisor. They’ll help you decide whether an ARM fits your financial situation and comfort level.

Bottom Line

ARMs can be a smart option for some buyers. But they’re not right for everyone. The most important thing is knowing how they work, reviewing the pros and cons, and deciding if they fit your financial plans. That’s why talking to a lender and financial expert is a must before making your decision.

Categories

Recent Posts