Your Equity Could Make a Move Possible

Your Equity Could Make a Move Possible

Many homeowners who are considering selling feel trapped by current circumstances. With today's mortgage rates higher than what they currently have, the prospect of selling and moving can seem less appealing. If you find yourself in a similar situation, there is a potential solution that might ease the burden of higher borrowing costs.

The key could lie in the equity you've built up in your current home. This accumulated equity could provide the financial leverage you need to offset the increased expenses associated with higher mortgage rates. By tapping into this equity, you may find the financial flexibility necessary to make your next move more feasible and financially sound.

What Is Equity?

Consider home equity as a straightforward mathematical concept. Freddie Mac describes it simply:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

Your equity increases both as you pay off your mortgage and as the value of your home rises. Given the significant increase in home prices in recent years, you likely have more equity than you might expect.

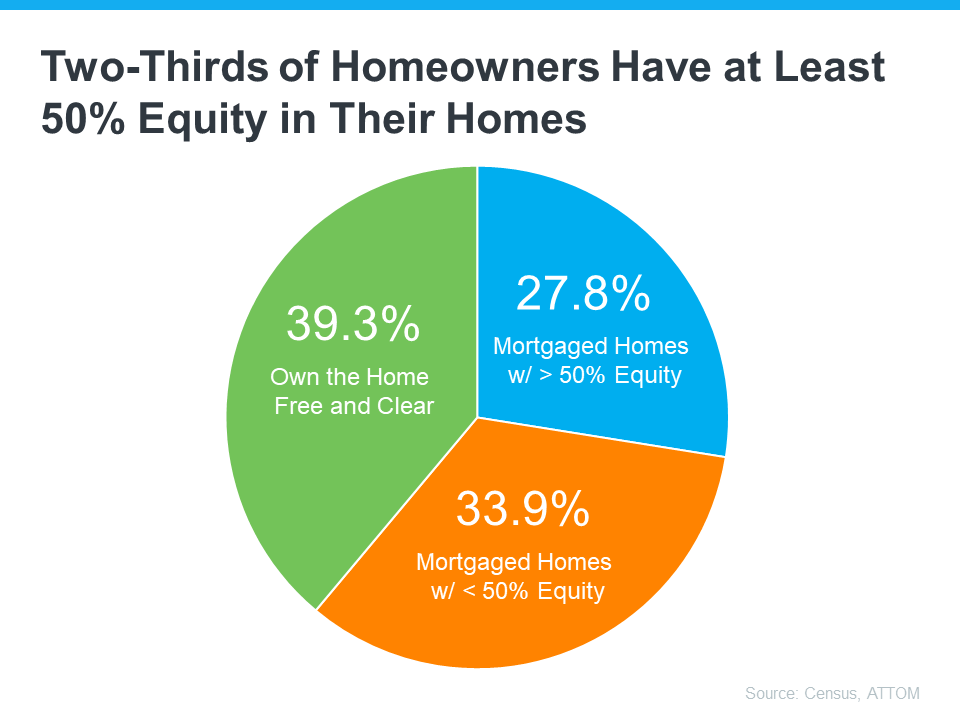

Recent data from the Census and ATTOM reveals that over two-thirds of homeowners are either mortgage-free (illustrated in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

That means the majority of homeowners have a game-changing amount of equity right now.

How Your Equity Can Help Fuel Your Move

After you sell your house, the equity you've accumulated can ease the transition to a new home, even amidst higher mortgage rates. Danielle Hale, Chief Economist at Realtor.com, notes that this equity can provide substantial financial support, helping you to manage the costs associated with purchasing your next home more comfortably:

“A consideration today's homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

To give you some examples, here are a few ways you can use equity to buy your next home:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates.

- Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much at today’s rates.

The First Step: Determine How Much Equity You Have in Your Home

Want to find out how much equity you have? To do that, you’ll need two things:

- The current mortgage balance on your home

- The current value of your home

You can typically locate your mortgage balance on your monthly mortgage statement. To determine the current market value of your house, you have options: you could spend hundreds on a professional appraisal, or you can reach out to a local real estate agent who can provide you with a Professional Equity Assessment Report (PEAR) at no cost.

Once you've connected with a trusted local agent and reviewed these figures, you'll be better positioned to make a move that might have seemed unrealistic before— all thanks to the equity you've built up in your home.

Bottom Line

If you're interested in discovering how much equity you have and exploring how it can facilitate your next move, let's connect. We can discuss your options and how you can leverage your home equity to achieve your goals.

Categories

Recent Posts