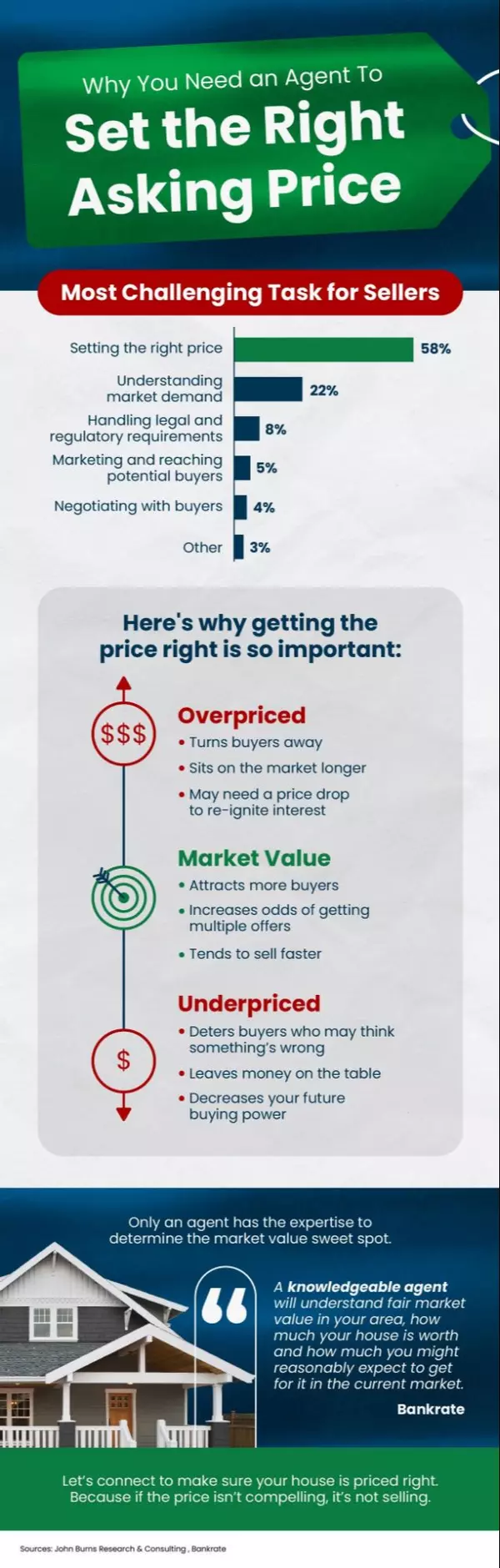

Your Agent Is the Key To Pricing Your House Right

Your Agent Is the Key To Pricing Your House Right The asking price for your house can significantly affect both your financial return and how swiftly your property sells. Setting the price too high or too low comes with its own set of challenges. To determine the most effective listing price, it's crucial to rely on the expertise of your real estate agent. Rather than arbitrarily choosing a figure, trust your agent’s knowledge and experience to guide you to the optimal price for your home.

Questions You May Have About Selling Your House

Questions You May Have About Selling Your House Mortgage rates are significantly influencing today's housing market, which might lead you to question whether it's still a good time to sell your house and make a move. Here are three common questions you might be asking, along with the data that can help you find the answers: 1. Should I Wait To Sell? If you're considering delaying your home sale until mortgage rates decrease, you're not alone—many others are thinking the same. However, while there are forecasts suggesting that mortgage rates may drop later this year, waiting for this dip could mean facing much more competition. Both buyers and sellers might re-enter the market at that time, increasing the competition. As Bright MLS notes: “Even a modest drop in rates will bring both more buyers and more sellers into the market.” That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home. 2. Are Buyers Still Out There? While some people are choosing to wait, there are still plenty of buyers actively looking for homes right now. The data to support this comes from the ShowingTime Showing Index, which tracks the frequency of home tours by buyers. The graph below, which utilizes this index, displays buyer activity for March (the latest data available) across the past seven years, illustrating the current level of interest in the housing market: Indeed, the demand has somewhat decreased compared to the 'unicorn' years, marked in pink on the graph. This shift is a response to various market factors, including higher mortgage rates, escalating prices, and limited housing inventory. However, for a clearer picture of today's market dynamics, it's more accurate to compare the current demand with what was considered normal during the last typical market years of 2018-2019, rather than the extraordinary 'unicorn' years. By focusing solely on the blue bars in the graph, which represent recent data, you can gauge how 2024 measures up. This comparison provides a fresh perspective on the current state of demand in the housing market. Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell. 3. Can I Afford To Buy My Next Home? If concerns about affording your next move with today's rates and prices are holding you back, it's worth considering the equity you might have accumulated in your current home. Over the past few years, homeowners have seen significant increases in home equity due to rising property values. This increase in equity can be a game-changer when purchasing your next home. You might even find that you have enough equity to buy your next home with cash, allowing you to bypass the mortgage process entirely. Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), elaborates on this topic: “ . . . those who have earned housing equity through home price appreciation are the current winners in today's housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.” Bottom Line If you've been pondering these three questions and they've been a barrier to selling your home, having this information might provide some clarity. A recent survey from Realtor.com reveals that more than 85% of potential sellers have been contemplating selling for over a year, indicating that many sellers are hesitating just like you. Interestingly, the same survey also gathered insights from sellers who recently made the decision to list their homes. Notably, 79% of these recent sellers expressed regret over not selling earlier. This statistic suggests that taking action sooner rather than later could lead to more satisfaction with the selling process. If you'd like to discuss any of these questions further or need more detailed information, let's connect. I'm here to help you navigate through your options and provide the insights you need to make an informed decision.

How Many Homes Are Investors Actually Buying?

How Many Homes Are Investors Actually Buying? If you're in the market for a house, you might have heard rumors or seen social media posts claiming that big investors are buying up all the available homes, making it tougher for the average buyer to find what they're looking for. However, it's important to separate fact from fiction. While there's a lot of misinformation circulating, the truth is that much of the significant investor activity has already peaked and is now diminishing. Here’s the real situation: big investor purchases have largely moved past their high point and are no longer dominating the housing market as they once might have. The Wall Street Journal (WSJ) explains: “Investors of all sizes spent billions of dollars buying homes during the pandemic. At the 2022 peak, they bought more than one in every four single-family homes sold, though more recently their activity has slowed as interest rates rose and supply became tighter.” The crucial point to understand is that investor activity in the housing market has significantly slowed. Even at the height of investor buying, three out of every four single-family homes were purchased by regular, everyday buyers—not investors. Furthermore, the majority of investors active over the past few years weren't the large-scale ones often discussed. Instead, they were predominantly small, "mom-and-pop" investors—people who might own just a few properties, such as their primary residence and perhaps a vacation home. However, the focus often shifts to the large, mega-investor firms—those owning over 1,000 properties—especially in discussions on social media. It might come as a surprise, but according to the Wall Street Journal, these mega investors actually purchase relatively few homes, which is evident in the data shown in the accompanying graph: The graph provides two key insights. First, institutional investors have never been the predominant buyers in the housing market. At their peak in 2022, they accounted for only about 2% of the available single-family homes. Second, their share of the market has decreased even further recently, to the point where it effectively rounds down to 0%. To shed light on why this downward trend is occurring, private lender RCN Capital conducted a survey asking investors about the challenges they face. Jeffrey Tesch, CEO of RCN Capital, shared the findings from this inquiry: “Investors are already facing many challenges in today’s housing market – rising prices, limited inventory, and higher financing costs.” Understanding these challenges is important because they show big, mega investors aren’t taking over the housing market. So, don't fall for everything you hear. They aren't snatching up all the homes and making it impossible for regular people to buy. Bottom Line Big investors aren’t dominating the home-buying market. If you have concerns or questions about what you’ve heard regarding the housing market, let’s have a conversation. I can help clarify what’s really happening and provide you with accurate insights.

Worried about Home Maintenance Costs? Consider This

Worried about Home Maintenance Costs? Consider This If one of your main concerns about buying a home is the potential upkeep involved, here’s some useful information regarding both new home construction and existing homes (those that have been previously owned). Newly Built Homes Need Less Upfront Maintenance If it's within your budget, opting for a newly built home might alleviate some concerns about maintenance costs. Consider this: if everything in the house is brand new, it won't have the wear and tear typical of an existing home, which translates to a lower likelihood of needing repairs soon. As LendingTree points out: “Since the systems, appliances, roof and foundation are new, you’re less likely to pay for major or minor repairs within the first few years of homeownership. That can make a big difference for first-time homebuyers who are adjusting to owning rather than renting.” Plus, many builders also have warranties on their homes that would cover some of the more major expenses that could pop up. As First American explains: “The new systems in your home, like plumbing, electrical, and HVAC, are typically covered for one to two years by your builder’s warranty. When something happens to these systems, you contact the builder or their warranty company.” Existing Homes Can Still Have Great Perks It's important to note that warranties aren't exclusive to newly built homes; they can also be an option for existing homes. Your real estate agent might be able to negotiate with the seller to include a home warranty as part of the sale. However, keep in mind that not all sellers will be open to this idea. If the seller isn't willing to provide a warranty, you have the option to purchase one yourself. Forbes discusses this further in one of their articles: “During a real estate transaction, a home warranty policy can be purchased by the buyer or the seller.” And there are benefits for both parties when it comes to a home warranty. According to MarketWatch: “A buyer’s home warranty benefits both buyers and sellers, as it helps the seller close the deal while providing the future homeowner with peace of mind that they’ll be covered if a system or appliance breaks down . . . Sometimes, a seller will pay for the first year of the home buyer’s warranty to sweeten the deal, but it depends on the real estate market.” If a home warranty for peace of mind interests you, rely on your agent to negotiate on your behalf. They can approach the seller to see if they'd be willing to include a warranty in the deal. However, remember that the likelihood of a seller agreeing to provide a warranty often depends on the conditions of your local market. So, Should I Buy New or Existing? While new construction offers the advantage of less immediate maintenance, there are unique benefits to existing homes that new builds can't match. For instance, existing homes often exude character and charm that are hard to replicate. The distinctive quirks of an older home can make it feel more welcoming and lived-in. Additionally, established homes typically feature mature landscaping and are part of well-developed communities, adding to their inviting atmosphere. Conversely, new constructions can feel like a blank slate, lacking these established features. Also, if you opt for a new build, you might face delays as you wait for construction to complete, depending on the stage of development. Ultimately, your choice depends on what you value most in a home. Bottom Line Whether you opt for a newly built or an existing home, a home warranty can help alleviate some of your concerns about maintenance. To explore your options and determine your top priorities, it's a good idea to consult with professionals. They can provide guidance tailored to your specific needs and help you make an informed decision.

Categories

Recent Posts