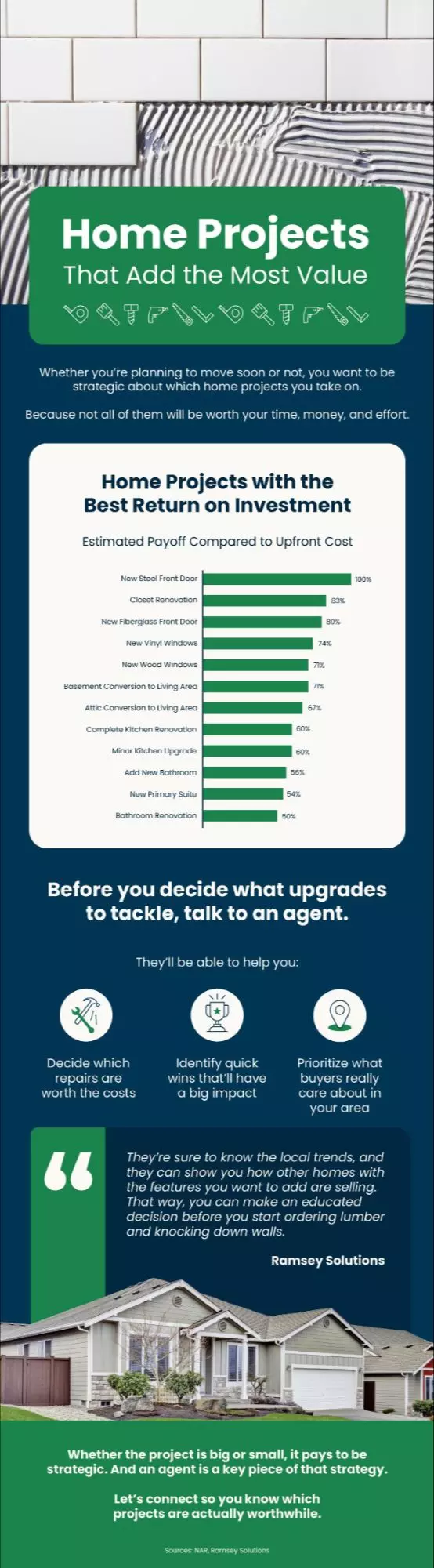

Home Projects That Boost Value

Home Projects That Boost Value Whether a move is on your horizon or not, it’s wise to carefully choose which home improvements you take on. Your time, money, and energy are valuable – and not every upgrade will bring the return you might hope for. As U.S. News Real Estate puts it: ". . . not every

Why You’ll Want a Home Inspection

Why You’ll Want a Home Inspection After your offer is accepted, a home inspection will evaluate the property's condition—covering areas like the roof, foundation, plumbing, and more. This critical step provides the insights you need to potentially re-negotiate with the seller, if necessary—so it’s

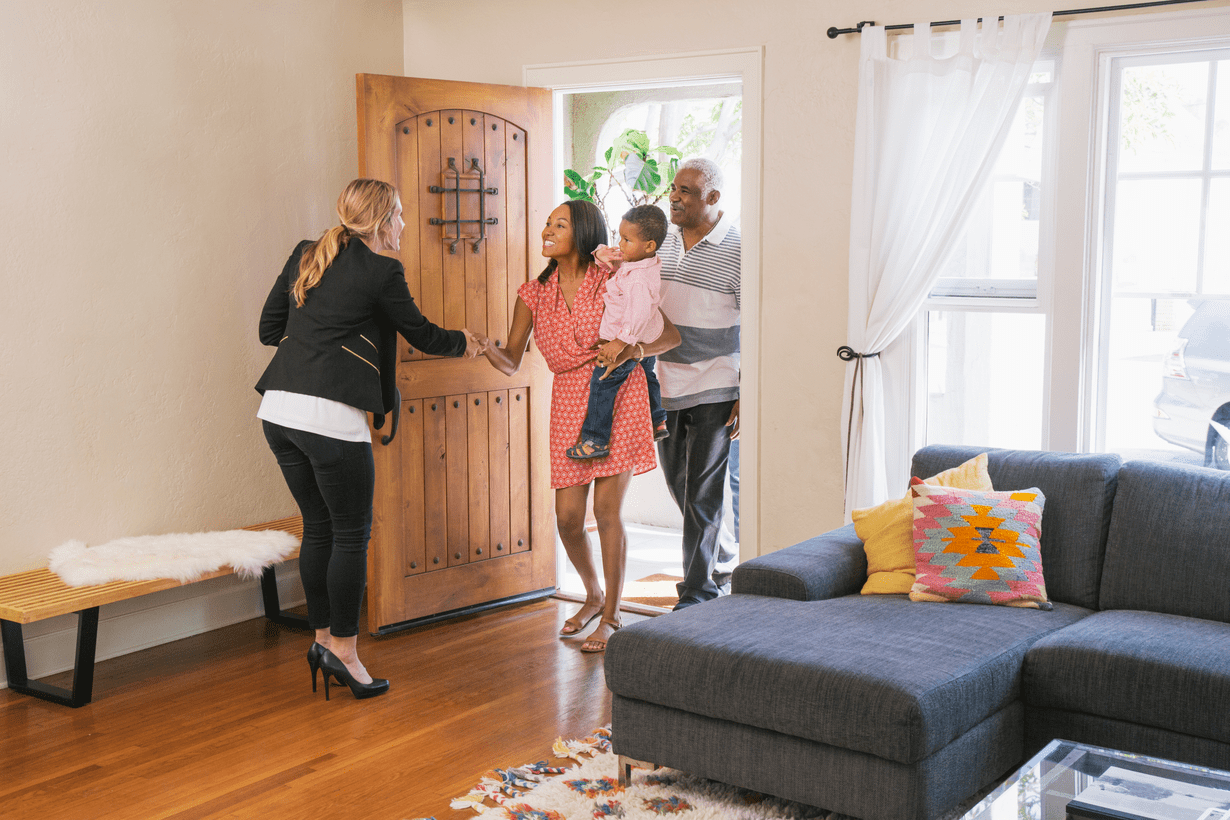

Why Some Homes Sell Faster Than Others

Why Some Homes Sell Faster Than Others As you start planning your move, you might’ve seen that some properties sell almost immediately, while others stay on the market. So, what causes that? According to Redfin: “. . . today’s housing market has been topsy-turvy since the pandemic. Low inventory (t

Stocks May Be Volatile, but Home Values Aren’t

Stocks May Be Volatile, but Home Values Aren’t With the economy in a state of uncertainty, the stock market has been fluctuating more than usual. If you’ve been tracking your 401(k) or investments recently, it’s likely you’ve experienced that unsettling feeling. One day, it’s up; the next, it’s dow

Categories

Recent Posts